July 2024 – Economic and Market Update

EXECUTIVE SUMMARY

- Does it matter to the economy who the President is? Maybe, but not much.

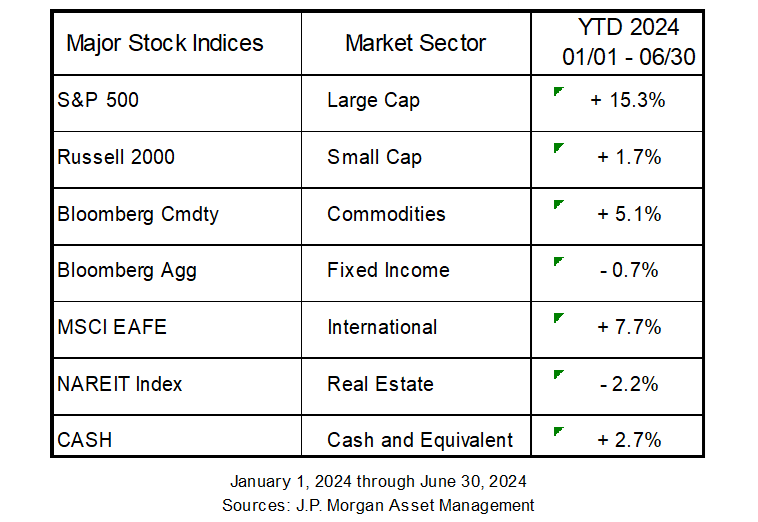

- A narrow market recovery continues to be driven by the Magnificent 7 stocks.

- The labor market has eased but remains strong. A key to growing forward will be continuing to attract non-native low-to-high skill workers.

- Scamming is getting more sophisticated, be aware and be skeptical.

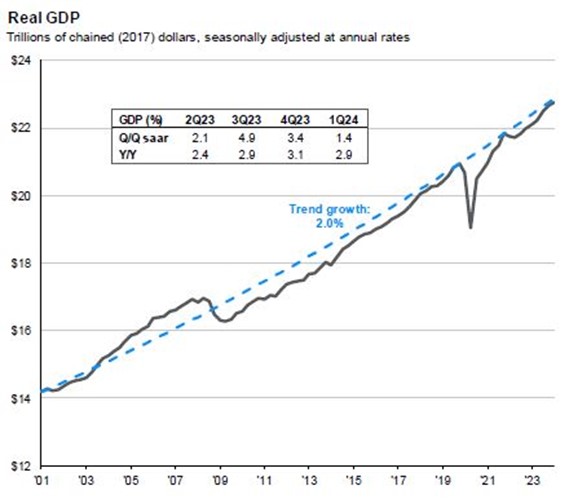

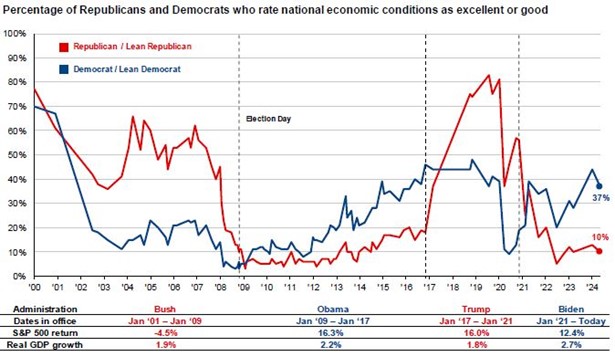

Economic momentum has remained solid but improvement on inflation has been slow. There are risks worth monitoring in the form of geo-political tension, but as a general observation, these are the same issues we have been dealing with for the last year or two. Momentum in the U.S. election for President this year seems to have swung sharply towards former President Trump. We are not in the habit of speculating on which direction the economy will go based on who the President is. The graph below can provide some context for that.

Source: BEA, FactSet, J.P.Morgan Asset Management – Guide to the Markets, U.S. Data are as of June 30, 2024

You can see that under former President Trump, GDP accelerated towards the historical trend line of GDP, then COVID hit. Under President Biden we have seen a similar return to trend GDP growth once we got past COVID. Partisan issues aside, returning to trend line GDP growth after the below trend early-mid 2010’s is good, a circumstance which occurred under both President Biden and President Trump.[i]

Source: Pew Research Center (May 2024), J.P.Morgan Asset Mgmt – Guide to the Markets, U.S. Data are as of June 30, 2024

It is also important to remember that how we feel about the economy has a lot to do with our political biases. The graph above shows this effect clearly. We like to think we are objective, but really, how we feel about the economy seems to have a lot to do with whether our preferred person is in the White House. So does it matter to the economy who is in the Oval Office, maybe, but not enough to make a huge difference in strategy. To be fair, we all thought things were terrible in early 2009, so at least we can all agree on that.

GDP, INFLATION and MARKET CONCENTRATION

The economy slowed sharply at the beginning of the year with annualized GDP growth of 1.3% but rebounded strongly in the 2nd quarter with a current annualized estimate of 2.7% GDP growth. This seems to be an indication that a soft-landing is more and more possible. The resiliency of the U.S. economy has been a shock.[ii]

Inflation improvement has stalled. There are disinflationary pressures out there, which is good, but getting to the end of the line has not occurred yet. Two large contributors to inflation have been shelter and auto insurance. In addition, we would add homeowners’ insurance to that mix depending on your location. Frustrations regarding housing costs have reached the point where President Biden floated the idea of a nationwide rent cap of 5%. Economically this is probably not a great idea, but it does show the frustration we all have with sticky inflation.[iii]

The Magnificent 7 stocks are still propping up the markets. In 2024, the Magnificent 7 have managed a 33% return versus the other 493 stocks in the S&P 500 at a cumulative 5% return. Rising tides are lifting the stock market but they are not necessarily lifting all the boats. The enthusiasm surrounding these magnificent 7 stocks is warranted, to a point, considering these stocks contributed nearly all the earnings growth for the S&P 500 in 2023, and most of the earnings growth so far in 2024. However, sky-high expectations create the opportunity for some very painful misses. You can see below the Magnificent 7 in green and the rest of the S&P in blue.[iv]

Source: FactSet, Standard & Poor’s, J.P. Morgan Asset Mgmt. – Guide to the Markets – U.S. Data are as of June 30, 2024

A quote attributed to John Maynard Keynes feels applicable to our current situation: “The market can stay irrational longer than you can stay solvent.”

For us this means sticking to prudent investment strategies based on your unique situation, and not betting one way or the other. Patience, diversification and a well-defined investment strategy are the keys to success. Reacting strongly to anomalous events such as the most concentrated S&P 500 in history is not the way to go.[v]

THE STRONG JOBS MARKET

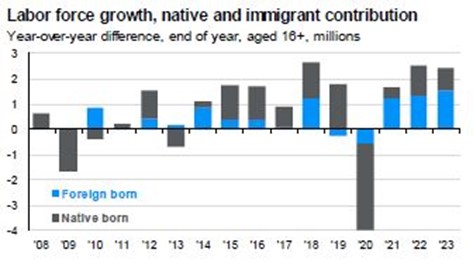

Labor growth in the U.S. has been strong and the labor market has normalized after the post-pandemic boom. A significant input to our labor pool has been net positive migration to the United States. In a world where many countries are facing population crises this is potentially a boon for the U.S., although it is an issue with a lot of politics involved.

A strong recovery in labor force participation between those aged 18 – 64 has boosted the U.S. economy, with many of those entering the country being in this cohort. Former President Trump was recently on a podcast speaking with prominent tech and venture capital leaders. He made the statement that if he is re-elected his administration would create a pathway to citizenship for non-resident students in the U.S. for education purposes. To people in Silicon Valley this was music to their ears as they try to attract foreign-born talent to fill open tech positions. Whoever our next President is, figuring out how to attract and retain the best from around the world will be a key to continued success.[vi]

Source: BLS, FactSet, J.P. Morgan Asset Management. Labor force data are sourced from the Current Population Survey, also known as the household survey, conducted by the BLS. This survey does not ask respondents about immigration status and may include undocumented workers, although it likely undercounts the undocumented population. Guide to the Markets -U.S. Data are as of June 30, 2024

As you can see in the graph above left, non-native workers (blue) are providing the majority of growth in the labor force. Based on the labor force participation rate on the right most of them are working. JOLTS job openings have receded dramatically from the pandemic high registered in March 2022, the pace of people quiting to find a new job has slackened, and layoffs remain relatively low. The labor market has eased some, but it is still quite strong. A focus on how we put people to work, and attract additional workers will be key as we see more and more baby boomers retire and leave the workforce.[vii]

INFLATION AND INTEREST RATES

Federal Reserve Bank of San Francisco President Mary Daly highlighted positive recent inflation data but stressed that the Fed has not yet achieved price stability. Speaking in Dallas, Daly emphasized the need for a sustainable path to price stability and noted that the Fed is still committed to its 2% inflation target. She mentioned that risks to the labor market and price stability are balancing out, but further slowing in the labor market could potentially raise unemployment rates. Despite confidence in inflation trends, the Fed remains cautious about lowering borrowing costs, with both markets and economists anticipating a September rate reduction. We have been here before though, maybe they cut rates, and maybe they don’t.

US inflation cooled in June, reaching the slowest pace since 2021 due to a notable slowdown in housing costs. Aside from being good news for President Biden, this data gives the Federal Reserve a strong signal that it may be able to cut interest rates, potentially starting in September. Fed Chair Jerome Powell, who described the recent inflation data as “really good,” emphasized that future policy moves would be data-driven, hinting at a possible rate cut later this year.[viii]

Source: Bloomberg, FactSet, J.P. Morgan Asset Mgmt.: Guide to the Markets – U.S. Data are as of June 30, 2024

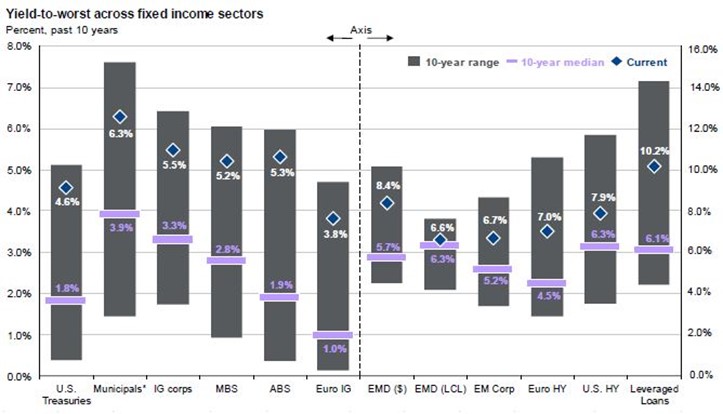

What this communicates to us is that it continues to be a good time to focus on the fixed income side of asset allocation strategies. Above is the Yield-to-Worst across a variety of fixed income sectors. Current yields remain far above the 10-year median represented by the purple line. There is an opportunity in fixed income that will be available for an unknown period of time. We continue to encourage clients sitting on the sidelines with cash to look at fixed income as a good way to do something as opposed to nothing. Defaults remain low across most fixed income sectors and yields are substantially better than they have been for years.

THE PLANNING CORNER – CYBERSECURITY AND SCAMS

Avoiding scams and phishing schemes is getting harder and harder these days. We regularly field a variety of questions from clients asking if something is real or a scam. This is an important area of concern for people in a world that is very connected, regardless of whether you are e-payment savvy or still write paper checks. This is also an area of abundant concern for retired individuals who are not forced to sit through cybersecurity meetings at work anymore. Cybersecurity is always evolving and retirement can, unfortunately, cause a previously very tech-oriented person to lose touch of the current state of affairs.

The most common item we see for users of email are phishing scams where you are asked to reply to reset your password for login or deal with an Amazon package refund. These are usually easily identified by checking the email address and seeing that it is some random extension that does not make any sense in the context of what you are being asked to do. Meaning the sender will be asking for a password reset for Microsoft but the email address is something like james@vemo-892×5!.com

Our advice: be skeptical and use good judgement.

One of the more insidious scams that we see coming up frequently is a virus notice on your computer asking you to call a number to fix the issue. The scammer will pose as an Apple or Microsoft tech support team member. Once you call you will be asked to perform a variety of tasks and possibly then re-routed to someone supposedly associated with some sort of reporting agency, such as the FTC (Federal Trade Commission) to report identity theft. Once you think you are talking to the FTC, they route you through to someone else from a different agency that will supposedly help you protect your assets by withdrawing them and putting them in safekeeping in the hands of someone else.

This seems far-fetched, unless you are in it.

Our advice: This one is hard, but call the most informed person you know, and trust, if you are not comfortable handling the issue on your own. Do not call the phone number provided in the pop-up, this is the entry point to the universe of the scammer. From there you will be fed a steady line of plausible sounding nonsense. For what it’s worth, the sage advice of “turn it off, and turn it back on” usually solves most problems.

Direct mail and spam phone calls are still a tried-and-true method for scammers. This is particularly an area of concern for the elderly. If you have aged parents living on their own and handling their finances this can be tricky. No one likes to talk about their finances and their competency to continue managing them. However, the potential impacts of not talking about these issues can be very costly. The unfortunate reality is that once money is gone there seems to be very little law enforcement can do.

We recently uncovered a scam when an older client asked us whether we could deposit a cashier’s check for them. Cashier’s checks are not standard operating procedure in the world of finance. If someone asks you to give them real money and then pay you back with a cashier’s check later, it’s a scam.

It is impossible to cover everything, but the most important thing to remember is that it can happen to you, it can happen to your family members, and it can happen to sophisticated people. A finance worker in Hong Kong recently transferred $25 million to scammers after participating in what he thought was a Zoom call with the CFO of his company. This was a video call using sophisticated deepfake technology. As you may have guessed, it wasn’t really the CFO.[ix]

Be skeptical, be wary, and be humble.

Our commitment to guiding you through these evolving economic conditions remains unwavering. We encourage you to reach out with any questions or concerns as we continue to move forward in an uncertain world.

DISCLOSURE

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any company names noted herein are for educational purposes only.

All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy. All economic and performance data is historical and not indicative of future results. Market indices discussed are unmanaged. Investors cannot invest in unmanaged indices. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards.

Investing in securities in emerging markets involves special risks due to specific factors such as increased volatility, currency fluctuations and differences in auditing and other financial standards. Securities in emerging markets are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments.

An index is a statistical measure of change in an economy or a securities market. In the case of financial markets, an index is an imaginary portfolio of securities representing a particular market or a portion of it. Each index has its own calculation methodology and is usually expressed in terms of a change from a base value. Thus, the percentage change is more important than the actual numeric value. An investment cannot be made directly into an index.

Investing in fixed income securities involves credit and interest rate risk. When interest rates rise, bond prices generally fall. Investing in commodities may involve greater volatility and is not suitable for all investors. Investing in a non-diversified fund that concentrates holdings into fewer securities or industries involves greater risk than investing in a more diversified fund. The equity securities of small companies may not be traded as often as equity securities of large companies so they may be difficult or impossible to sell. Neither diversification nor asset allocation assure a profit or protect against a loss in declining markets. Past performance is not an indicator of future results.

Sean P. Storck and Steven W. Pollock are registered representatives with and securities and Retirement Plan Consulting Program advisory services offered through LPL Financial, a Registered Investment Advisor. Member FINRA/SIPC. Financial Planning offered through Reason Financial, a state Registered Investment Advisor. Investment advice offered through Merit Financial Group, LLC an SEC Registered Investment Advisor. Merit Financial Group and Reason Financial are separate entities from LPL Financial. Tax related services offered through Reason Tax Group. Reason Tax Group is a separate legal entity and not affiliated with LPL Financial. LPL Financial does not offer tax advice or tax related services. Sean P. Storck CA Insurance Lic#OF25995 and Steven W. Pollock CA Insurance Lic#OE98073

Copyright © 2024 Reason Financial all rights reserved.

[i] Eric Cortellessa/Butler, Pa., and Brian Bennett/Milwaukee. “It’s Trump’s Race to Lose.” Time, Time, 19 July 2024, time.com/7000530/trumps-race-ascendant-milwaukee-speech-rnc/.

[ii] “GDPNow.” Federal Reserve Bank of Atlanta, 17 July 2024, www.atlantafed.org/cqer/research/gdpnow

[iii] “Fact Sheet: President Biden Announces Major New Actions to Lower Housing Costs by Limiting Rent Increases and Building More Homes.” The White House, The United States Government, 16 July 2024, www.whitehouse.gov/briefing-room/statements-releases/2024/07/16/fact-sheet-president-biden-announces-major-new-actions-to-lower-housing-costs-by-limiting-rent-increases-and-building-more-homes/.

[iv] Butters, John. “Are the ‘Magnificent 7’ the Top Contributors to Earnings Growth for the S&P 500 for Q1?” FactSet Insight – Commentary and Research from Our Desk to Yours, 22 Apr. 2024, insight.factset.com/are-the-magnificent-7-the-top-contributors-to-earnings-growth-for-the-sp-500-for-q1.

[v] Salmon, Felix. “The Stock Market’s Concentration, in One Chart.” Axios, 27 June 2024, www.axios.com/2024/06/27/the-stock-markets-concentration-in-one-chart.

[vi] Chamath, et al. “In Conversation With President Trump.” YouTube, All-In Podcast, 20 June 2024, www.youtube.com/watch?v=blqIZGXWUpU.

[vii] “JOLTS Latest Numbers.” U.S. Bureau of Labor Statistics, U.S. Bureau of Labor Statistics, May 2024, www.bls.gov/jlt/latest-numbers.htm.

[viii] Smith, Molly. “US Inflation Broadly Cools, Likely Sealing Deal for Fed Rate Cut.” Bloomberg.Com, Bloomberg, 11 July 2024, www.bloomberg.com/news/articles/2024-07-11/us-inflation-broadly-cools-bolstering-case-for-fed-rate-cut?itm_source=record&itm_campaign=US_Inflation&itm_content=US_Inflation_Broadly_Cools-0.

[ix] Olson, Parmy. “A $25 Million Hong Kong Deepfake Scam on Zoom Shows New AI Risks.” Bloomberg.Com, Bloomberg, 5 Feb. 2024, www.bloomberg.com/opinion/articles/2024-02-05/a-25-million-hong-kong-deepfake-scam-on-zoom-shows-new-ai-risks.