October 2024 – Economic and Market Update

EXECUTIVE SUMMARY

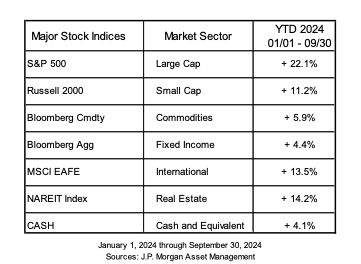

- Stock indices are high and returns across all major asset classes are positive this year.

- Market volatility spikes when the incumbent party loses the White House, but who is the incumbent?

- Forward returns are not looking overly optimistic; check your risk and take your gains if your goals have changed.

Markets just keep on holding on. In the last quarter, domestic equities performed well with the S&P 500 adding an additional increase of 5.9% averaged across all sectors.[i] Fixed income has provided positive growth and solid yield. International markets have held up, for the most part, although Germany is not doing so hot.[ii] The labor market in the United States has continued to soften. There have been frequent revisions to the monthly job creation data, usually to the downside.[iii] The labor market is cooling, but there have not been any terrible surprises to speak of. Household savings rates have cooled and household debt servicing ratios have continued to rise, albeit still below levels seen in the early 2000s.[iv]

Inflation seems to have become entrenched above the Federal Reserve target of 2%, but has no meaningful upward momentum after the first rate cut earlier this year. The Federal Reserve uses the PCE rate as its preferred gauge, which is currently at 2.1% as of September 2024. Market expectations are for additional rate cuts by the Fed in November and December. We shall see.[v]

MARKETS AND THE ELECTION

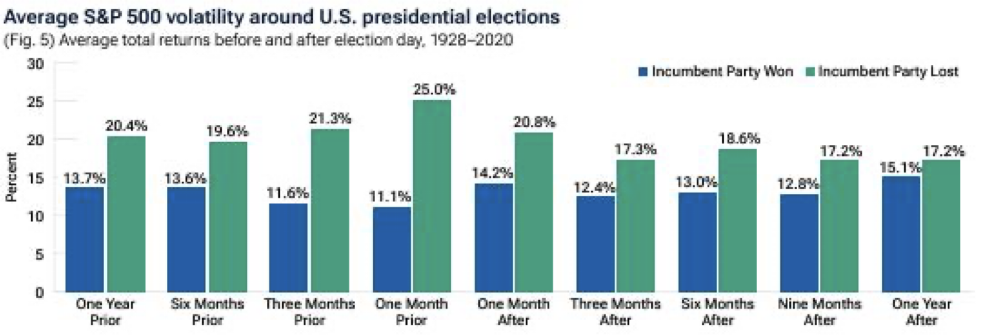

Market returns around election cycles can be looked at in different ways. For our purposes, we will look at average volatility when the incumbent wins vs. average volatility when the incumbent loses. This time is a little different. Trump and Harris both feel like incumbents the way the last 8 years have played out, even though they aren’t.

December 31, 1927, to November 3, 2021

Past Performance is not a reliable indicator of future performance.

Source: T.Rowe Price analysis of data from Bloomberg Finance L.P. See Additional Disclosure

Volatility for the one year prior to the 1928 election was excluded from the sample because of lack of available data. Volatility is the standard deviation in daly S&P 500 returns for the specified period. Standard deviation measures the amount of variation or dispersion in a set of values. A low standard deviation indicates that the values tend to be close to the mean of the set; a high standard deviation indicates that the values are spread out over a wider range.

As you can see in the graph above, heading into and after an election in which the incumbent party loses, volatility historically edges up significantly. However, which candidate is the incumbent in this scenario? It feels like a valid question to ask considering the current circumstances.

That said, it is reasonable to anticipate we will see an increase in volatility under either candidate winning. Under a President Harris the tax regime we have lived under for the last 6 years may change dramatically. Under a President Trump there may be signficant changes in both trade and foreign policy. There are other policy issues you can point to, but these are likely the biggest. Markets like clarity and stalemates. It is not clear that is on the table with either candidate. The best advice right now is to buckle up and ride out whatever we are going to see. The economy is holding steady, and if that continues volatility should work itself out of the system. Another observation from the graph above: the further out we move from the election, the more the volatility gap narrows. It just takes time.

EXPECTED RETURNS

This year has been an exceptional year on the stock market. At the start of the year the majority of predictions were for low to negative returns. Instead, the markets have hummed along while the economy has continued to slow.

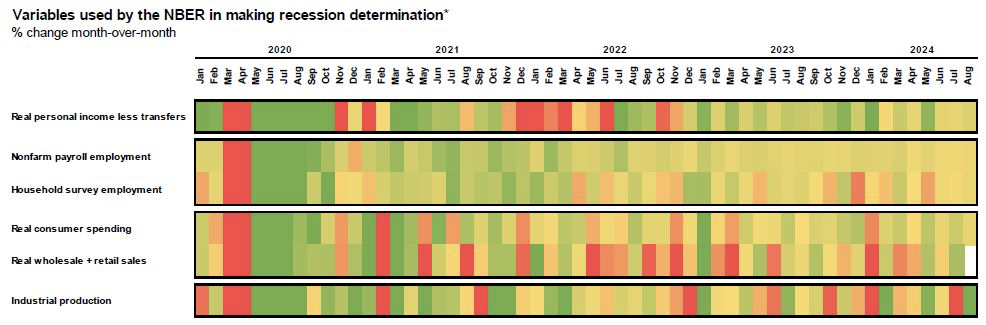

Source: BEA, BLS, Census Bureau, NBER, J.P. Morgan Asset Mgmt, Guide to the Markets – U.S. Data are as of September 30, 2024

Based on the graph, as the year has progressed from left to right, economic data has generally trended weaker. Industrial production and retail sales have bounced around from green to red and back to green, but the other markers have trended weaker or flat. Nonetheless, markets rose higher.

Source: FactSet, Refinitiv Datastream, Standard & Poor’s, Thomson Reuters, J.P. Morgan Asset Management

Guide to the markets – U.S. Data are as of September 30, 2024

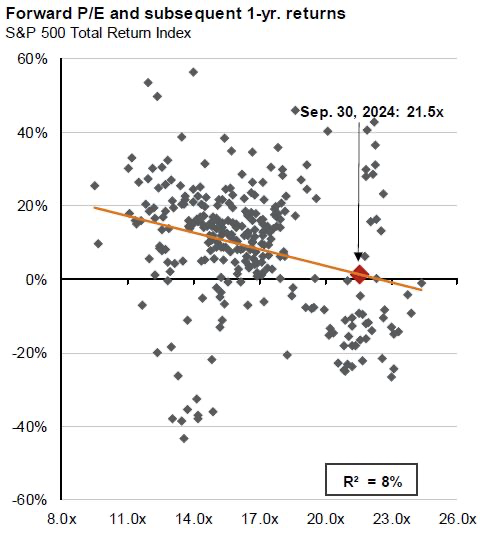

In some respects, this lack of predictability is to be expected. We are way out on the P/E Ratio scale. The red dot represents where we are on a forward looking basis. Expected returns are all over the place. At lower P/E ratios you can see how the data clusters and expectations are easier to set. Where we are, flip a coin. Are we up next year? Maybe. Are we down next year? Also a maybe. It is hard to predict what is coming.

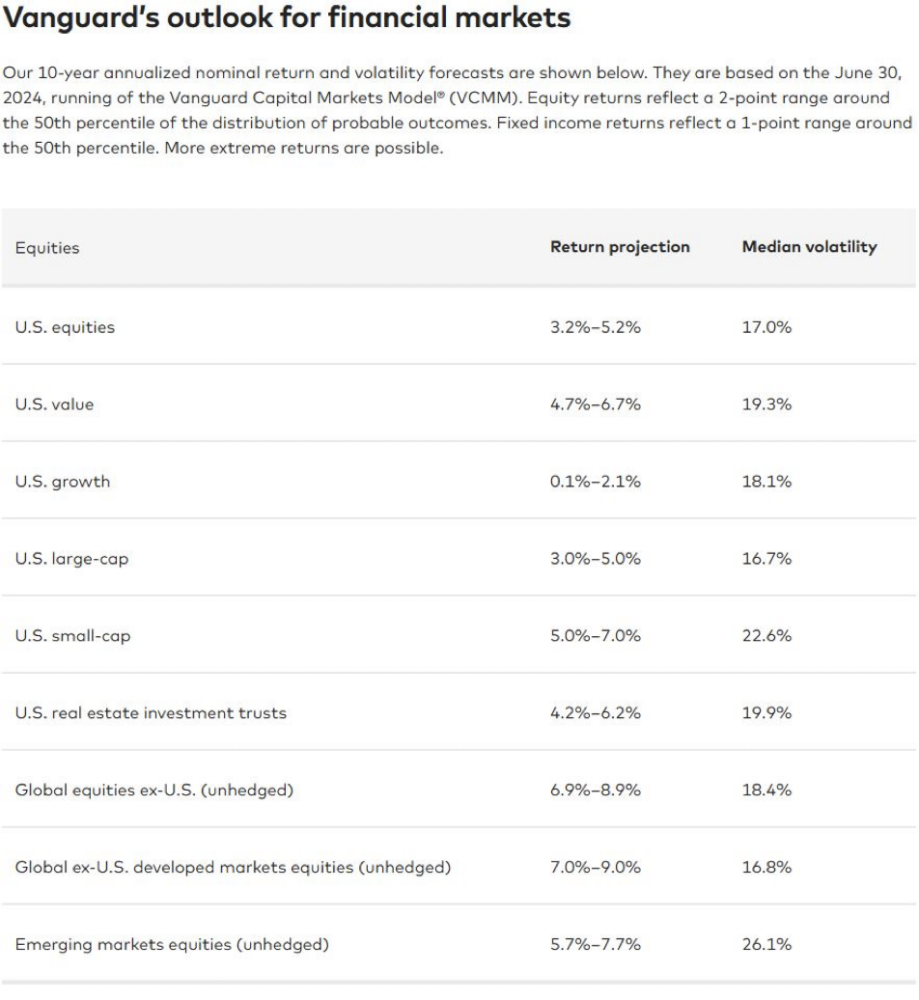

On a longer term basis, looking out 5 to 10 years, expected returns are more predictable and they are lower than what we have experienced in the last few years. Vanguard recently released their forward looking guidance for the markets over the next 10 years.

Source: Vanguard Investment Strategy Group. The projections or other information generated by the Vanguard Capital Markets Model regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Distribution of return outcomes from VCMM are derived from 10,000 simulations for each modeled asset class. Simulations are as of June 30, 2024. Results from the model may vary with each use and over time.

Vanguard’s current prediction for the next 10 years of annualized nominal returns for U.S. growth stocks is .1% – 2.1% and U.S. equities as a whole between 3.2% – 5.2%. This is not quite a prediction of a secular bear market arriving, but it is not far off.[vi]

It is not a time to be careless about the type of risk present in investment portfolios. It has been good, but good times do not last. History has shown us repeatedly that we can expect both bull and bear markets. For comparison, their prediction for the annualized nominal return for U.S. Aggregate Bonds is 4.5% – 5.5%, with a fraction of the volatility. We recommend looking at the risk you are carrying in your retirement accounts, college savings accounts, and investment accounts. This is most important if you are nearing retirement, nearing the time you expect your children to enter college, or are near making a major purchase decision such as a house. Taking some risk off the table is a prudent move.[vii]

Late last week it made news that Berkshire Hathaway is sitting on $325 billion in cash after Warren Buffett sold off billions of dollars worth of Apple and Bank of America shares. We do not share this as a particular strategy everyone should take. We point to it as an example of taking an active interest in managing the risk in your portfolios. Everyone has different goals and different intentions on how long they are going to work and how they are going to fund retirement. Everyone should make sure that the strategy they put in place years ago is still appropriate for the life circumstances they are in now.[viii]

Maybe Warren Buffett is hoarding cash because he wants to fill a giant tower with money to jump in like Scrooge McDuck. Or he might be expecting to go bargain shopping sometime soon.

THE PLANNING CORNER – END OF YEAR TAX PLANNING

This is the perfect time to begin planning to minimize your taxes for 2024. You have two months left to do something about it. Once the clock ticks over to 12:01 a.m. on January 1, 2025, the actions you can take are severely limited.

Paying lower taxes is always a trade-off. You can fund an IRA and get a tax deduction today, but you cannot, generally, access the money again until the age of 59 ½. Tax deferral almost always comes with a liquidity tradeoff.

Or it comes in the form of less money in your pocket. For example, you can contribute to charity and take a deduction on your tax return as long as you itemize deductions. If your combined tax rate between Fed/CA is 35%, that means you give $1 to get back 35 cents. A great deal if you are charitably inclined, but you are still out 65 cents.

Here are a variety of actions you can take. Some will apply to individuals and others to businesses.

Individuals

- Make sure you are max funding your 401k.

- Fund an IRA for 2024, you have until 04/15/25 to do this, but why wait?

- Make sure you take your RMD from your retirement accounts.

- If you are charitably inclined and over the age of 70 ½ you can perform a Qualified Charitable Distribution.

- Gift appreciated stock to charity.

- Max fund your Health Savings Account if you have a compatible health insurance plan.

- Gift to charity.

- Do that housecleaning you talked about for the last decade and give your old household goods and clothes to Goodwill or a similar charity. Remember to get your receipt!

- Check your non-retirement investment accounts for tax-loss harvesting opportunities.

- Review your cryptocurrency positions and take advantage of the lack of wash sale rules and loss harvest losing positions.

- If you are planning on making energy efficient improvements, accelerate the timeline into the current year.

- Strategically use your tax situation to engage in a Roth conversion strategy.

- Pay for college tuition in 2024 for Spring Semester 2025

Businesses

- Establish a SoloK for your small business without employees.

- Establish a retirement plan (401k, SIMPLE, SEP, Cash Balance) for your business with employees.

- Make sure you pay the PTE tax payment by 12/31/24, if you are making the election.

- Review upcoming expenses for early 2025 and see if there are any that can be accelerated into 2024.

- Defer income into next year if possible.

- Accelerate fixed asset purchases – 60% Bonus Depreciation in 2024 drops to 40% in 2025.

If you have had a unique year and are not sure where things are going to land, you can engage us to prepare a tax plan for you. This is a great way to get ahead and make sure you are not going to run afoul of the underpayment safe-harbor provisions. If this year looked a whole lot like last year, then not so big of a deal. If you went through major changes getting an early estimate on where you land can be helpful.

Our commitment to guiding you through these evolving economic conditions remains unwavering. We encourage you to reach out with any questions or concerns as we continue to move forward in an uncertain world.

DISCLOSURE

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any company names noted herein are for educational purposes only.

All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy. All economic and performance data is historical and not indicative of future results. Market indices discussed are unmanaged. Investors cannot invest in unmanaged indices. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards.

Investing in securities in emerging markets involves special risks due to specific factors such as increased volatility, currency fluctuations and differences in auditing and other financial standards. Securities in emerging markets are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments.

An index is a statistical measure of change in an economy or a securities market. In the case of financial markets, an index is an imaginary portfolio of securities representing a particular market or a portion of it. Each index has its own calculation methodology and is usually expressed in terms of a change from a base value. Thus, the percentage change is more important than the actual numeric value. An investment cannot be made directly into an index.

Investing in fixed income securities involves credit and interest rate risk. When interest rates rise, bond prices generally fall. Investing in commodities may involve greater volatility and is not suitable for all investors. Investing in a non-diversified fund that concentrates holdings into fewer securities or industries involves greater risk than investing in a more diversified fund. The equity securities of small companies may not be traded as often as equity securities of large companies so they may be difficult or impossible to sell. Neither diversification nor asset allocation assure a profit or protect against a loss in declining markets. Past performance is not an indicator of future results.

Sean P. Storck and Steven W. Pollock are registered representatives with and securities and Retirement Plan Consulting Program advisory services offered through LPL Financial, a Registered Investment Advisor. Member FINRA/SIPC. Financial Planning offered through Reason Financial, a state Registered Investment Advisor. Investment advice offered through Merit Financial Group, LLC an SEC Registered Investment Advisor. Merit Financial Group and Reason Financial are separate entities from LPL Financial. Tax related services offered through Reason Tax Group. Reason Tax Group is a separate legal entity and not affiliated with LPL Financial. LPL Financial does not offer tax advice or tax related services. Sean P. Storck CA Insurance Lic#OF25995 and Steven W. Pollock CA Insurance Lic#OE98073

Copyright © 2024 Reason Financial all rights reserved.

[i] Research, NEPC. “Quarterly Asset Class Review: Q3 2024.” NEPC, 28 Oct. 2024, www.nepc.com/quarterly-asset-class-review-q3-2024/.

[ii] Chazan, Guy. Germany Expects Economy to Shrink in 2024 after Cutting Forecast, Financial Times, 9 Oct. 2024, www.ft.com/content/04fd5114-976d-4a6f-bf5a-176a0671757b.

[iii] Wallace, Alicia. “New Data Shows Us Job Growth Has Been Far Weaker than Initially Reported | CNN Business.” CNN, Cable News Network, 21 Aug. 2024, www.cnn.com/2024/08/21/economy/bls-jobs-revisions/index.html.

[iv] Caporal, Jack. “Total Household Debt by Type.” The Motley Fool, The Motley Fool, 26 Aug. 2024, www.fool.com/money/research/average-household-debt/#:~:text=Total%20debt%20is%20up%20by,seen%20since%20the%202008%20recession.

[v] “Inflation (PCE).” Board of Governors of the Federal Reserve System, Federal Reserve, Sept. 2024, www.federalreserve.gov/economy-at-a-glance-inflation-pce.htm.

[vi] “Market Perspectives.” Our Investment and Economic Outlook, October 2024, Vanguard , 22 Oct. 2024, advisors.vanguard.com/insights/article/series/market-perspectives#projected-returns.

[vii] “Market Perspectives.” Our Investment and Economic Outlook, October 2024, Vanguard , 22 Oct. 2024, advisors.vanguard.com/insights/article/series/market-perspectives#projected-returns.

[viii] Funk, Josh. “Warren Buffett Is Sitting on over $325 Billion Cash as Berkshire Hathaway Keeps Selling Apple Stock.” AP News, AP News, 3 Nov. 2024, apnews.com/article/warren-buffett-berkshire-hathaway-earnings-profit-6f2772721d5d8f00578f8265c70db3d1.