April 2023 – Economic and Market Update

EXECUTIVE SUMMARY

- This year is better than last year so far, especially for fixed income. We are maintaining our focus on shorter duration due to a sustained inverted yield curve.

- Inflation continues to ease. The costs of housing will likely take longer to correct than hoped for, with most loans being at very low interest rates obtained during the COVID pandemic.

- The markets are still mismatching the Federal Reserve on interest rate expectations. We think this is a bad call based on language from Chair Powell and on the strength of the job market providing room for them to move.

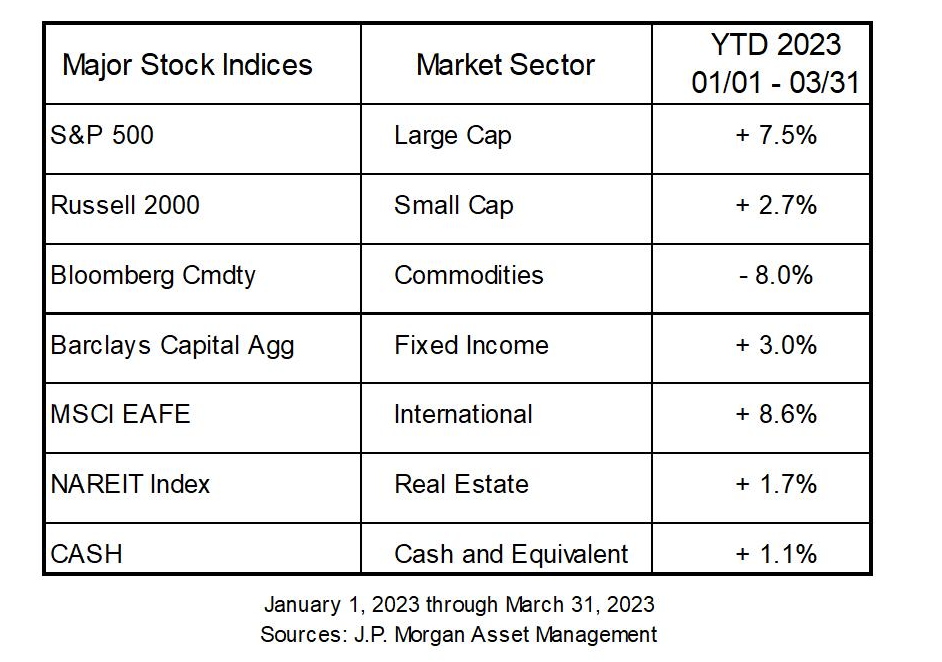

This year has seen the complete reversal of the commodity picture that we saw in 2022. Last year, commodities were the best-performing asset class; this year, they have been the worst. This is a typical trend for commodities as they move from boom to bust. International markets have performed the best, marking the first time they have led the pack in the last 15 years. Whether or not that continues with the

geopolitical risks facing developed international markets is unknown. U.S. markets have stabilized so far, although calls for the likelihood of a recession are increasing. Encouragingly, we are seeing fixed income recover from a historically bad performance in 2022. We are still staying on the short side of duration, with the yield curve continuing to be inverted for what is now a prolonged period of time.

GOOD NEWS AND EXPECTATIONS ON INFLATION

We are experiencing a moderation in inflation, as you can see in the graph below, with significant improvement in the utilities, food, and automotive categories. If the overall trend as you move from right to left is towards green shaded colors then the trend is good. On the flip side, trending towards red is bad. Natural gas prices fell dramatically at the tail end of the first quarter, helping local (SDGE) households substantially. Shelter is still expensive. It takes time for higher interest rates to work their way through the housing market and be reflected in lower rents and lower purchase prices.

An additional problem on the housing side is that with the heavy refinancing done during the pandemic, it could take a while to see any meaningful adjustment in real estate costs. As unbelievable as it may feel

now, it was possible to refinance or obtain a new mortgage with rates under 3% for a 30-year fixed-rate loan a short time ago. As you can see below, a large percentage of outstanding loans were originated during a window of very cheap lending. This is great for owners but not so great for the Federal Reserve when they are trying to slow the economy and reduce inflation. With most owners not feeling the pinch of higher rates, the correction in pricing will be on a forward-moving basis. Hence, a serious lag in seeing the effects of higher rates reflected in housing cost reductions. i

On a positive note, the services sector is witnessing falling prices. According to the most recent Bureau of Labor Statistics report on April 13th, “Prices for final demand services moved down 0.3 percent in March. The largest decline since falling 0.5 percent in April 2020,” potentially signaling further inflation easing. Retail spending is holding strong, and while the Federal Reserve is expected to introduce more interest rate increases, their language suggests a possible reduction in the likelihood of future hikes.ii

Fed Policy and Inflation

Market expectations of a rate cut from the Federal Reserve are likely incorrect, given high inflation and low unemployment rates. We are of the opinion that we should not expect rate cuts. Some of this is rooted

in taking Fed Chair Jerome Powell at his word, and some of it is our long-held belief that inflation will be harder to root out than the market is anticipating.

Current Federal Reserve positioning is as follows from the last press conference given by Chair Powell:

“As a result, we no longer state that we anticipate that ongoing rate increases will be appropriate to quell inflation; instead, we now anticipate that some additional policy firming may be appropriate…In that most likely case, if that happens, participants don’t see rate cuts this year, they just don’t.”iii

In other words, we may not see increasing interest rates for much longer, but we are not planning on reducing them either. When he references participants, he is referring to the Federal Reserve Governors who contribute to the brain trust of the Fed.

The market continues to mismatch the Federal Reserve. The greenish dotted line above is the average of market expectations of the future of interest rates versus the dark blue dotted line of the FOMC (Federal

Open Market Committee) projections. The market is pricing in a rate decrease before the end of the year while the Fed is saying it isn’t happening. If our expectations were to be superimposed in the graph above, they would be further to the right of the Federal Reserve expectations. We think we will need to see rates higher for longer.

An additional quote from Chair Powell:

“Reducing inflation is likely to require a period of below-trend growth and some softening in labor market conditions.”iv

Our interpretation of this statement is that the Federal Reserve is going to be very patient with decreasing rates. Wage growth has been solid, although real wage growth adjusted by inflation has not been good. Unemployment is very low, and while the job openings versus those looking for work measurement has improved, it is still very competitive out there. The job market is so strong at this point in time that there is a lot of wiggle room for the “softening” to occur before it reaches a level where the Federal Reserve would feel the need to take corrective action to ease up. Put it all together, and we think there will be no rate cuts in the immediate future, and we could see worsening conditions for some time before rate cuts actually occur.

International Markets and Oppotunity

International markets have been the best performer of the year so far. This is a long time coming. In the graph below, you can see how long it has been since that was the case. U.S. outperformance is in gray, and international outperformance is in purple. We are looking at the opportunities presented by this mismatch. It is important to note the qualifiers we have on looking for international investment opportunities. Geopolitical risk is of high concern. This makes choosing to invest in Europe challenging with the possible expansion of the war in Ukraine. It also makes investing in East Asia challenging with the circumstances presented by China’s aggressive posturing and continued trade rhetoric between the U.S. and China. To this point, Warren Buffet sold out of his position in Taiwan Semiconductor Manufacturing Co. When pressed on whether or not he sold due to geopolitical considerations, he said, “That is certainly a consideration…Is there a difference between that (sic) being located in Omaha, Nebraska, and in Taiwan? Yes.”v

The possibilities in expanding to a more diverse allocation are not just trend-based. At this point in time, international stocks are incredibly cheap.

Historically speaking, it is a good idea to be a buyer when there is a negative two standard deviation difference in P.E. ratios from the long-term average. We are evaluating opportunities in the international space and looking for ways to get around the geopolitical risks.

A Bit On The Downer Side

The markers used by the NBER to determine whether a recession is here or not have seen some deterioration since last quarter. Weakening consumer spending along with weakening real personal income is a strong sign of the economy slowing down. In addition, the repo man is seeing an uptick in business.

Auto and credit card loan defaults are rising in a not so subtle sign that the economy is weakening. The easiest credit to obtain for many people is a credit card or an auto-loan, so it is not very surprising those would be the areas where we see the first signs of labor market and economic weakness begin to show up. Recessions typically hit lower incomes ranges first and hardest. People who carry open credit card balances and auto-debt are more likely to be sub-prime borrowers. The dots are not hard to connect.vi

The markets have rebounded to start 2023, and there are opportunities out there. However, there is evidence that the battle against inflation is beginning to work in the slowing down of the economy. Given the environment, our investment strategy prioritizes quality and cash flow, with a focus on risk management. We have made adjustments to our low volatility strategy with the aim of participating in a market recovery and still attempting to manage the risks we see out there.

The Planning Corner

The yield curve is strongly inverted right now. When only one data point is available, such as a bank advertisement indicating a promotional certificate of deposit rate, it can be hard to know what else is out there, and what is a good deal or not. The best rates are going to be on the short end of the curve out to about 12 months. As you can see on the far left side of the graph above, rates start to drop precipitously after about the 6-month mark before stabilizing, with little difference in the 3 to 30-year term range. If you

are looking for higher-yielding cash alternatives, please keep this in mind. There is not a lot to be gained in going further out on the yield curve.

With the recent turmoil in the banking industry, we also suggest paying attention to FDIC coverage limits. We do not believe we are going to see a wider contagion of bank failures. The reality is that the Federal Reserve has indicated very clearly the path rates were/are going. Any failure by a bank to hedge against that happening was very poor risk management. Paying attention to FDIC coverage limits is just good risk management, as is paying attention to term and rate risk. We are always happy to discuss cash alternatives for yield.

As always, our desire is to help you make rational, informed and well-reasoned decisions, and we thank you for your continued trust and support. Your input is always welcome and we ask that you contact us with any questions or concerns.

DISCLOSURE

All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy. All economic and performance data is historical and not indicative of future results. Market indices discussed are unmanaged. Investors cannot invest in unmanaged indices. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards.

Investing in securities in emerging markets involves special risks due to specific factors such as increased volatility, currency fluctuations and differences in auditing and other financial standards. Securities in emerging markets are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments.

An index is a statistical measure of change in an economy or a securities market. In the case of financial markets, an index is an imaginary portfolio of securities representing a particular market or a portion of it. Each index has its own calculation methodology and is usually expressed in terms of a change from a base value. Thus, the percentage change is more important than the actual numeric value. An investment cannot be made directly into an index.

Investing in fixed income securities involves credit and interest rate risk. When interest rates rise, bond prices generally fall. Investing in commodities may involve greater volatility and is not suitable for all investors. Investing in a non-diversified fund that concentrates holdings into fewer securities or industries involves greater risk than investing in a more diversified fund. The equity securities of small companies may not be traded as often as equity securities of large companies so they may be difficult or impossible to sell. Neither diversification nor asset allocation assure a profit or protect against a loss in declining markets. Past performance is not an indicator of future results.

Sean P. Storck and Steven W. Pollock are registered representatives with and securities and Retirement Plan Consulting Program advisory services offered through LPL Financial, a Registered Investment Advisor. Member FINRA/SIPC. Financial Planning offered through Reason Financial, a state Registered Investment Advisor. Investment advice offered through Merit Financial Group, LLC an SEC Registered Investment Advisor. Merit Financial Group and Reason Financial are separate entities from LPL Financial. Tax related services offered through Reason Tax Group. Reason Tax Group is a separate legal entity and not affiliated with LPL Financial. LPL Financial does not offer tax advice or tax related services. Sean P. Storck CA Insurance Lic#OF25995 and Steven W. Pollock CA Insurance Lic#OE98073

Copyright © 2021 Reason Financial all rights reserved.

i Holland, Ben. “Are US Interest Rates Going up? Most Mortgages Locked in at Historic Lows.” Bloomberg.com, Bloomberg, 3 Mar. 2023, https://www.bloomberg.com/news/articles/2023-03-03/most-us-mortgages-are-pandemic-vintage-locked-beyond-fed-reach.

ii “Producer Price Indexes – March 2023.” Producer Price Indexes, U.S. Bureau of Labor Statistics, 13 Apr. 2023, https://www.bls.gov/ppi/#:~:text=The%20Producer%20Price%20Index%20for,12%20months%20ended%20in%20March. Accessed 15 Apr. 2023.

iii “FOMC Press Conference, March 22, 2023.” YouTube, YouTube, 22 Mar. 2023, https://www.youtube.com/watch?v=y3dt5ZyL2OU&ab_channel=FederalReserve. Accessed 27 Apr. 2023.

iv “FOMC Press Conference, March 22, 2023.” YouTube, YouTube, 22 Mar. 2023, https://www.youtube.com/watch?v=y3dt5ZyL2OU&ab_channel=FederalReserve. Accessed 27 Apr. 2023.

v Price, Growth at a Good. “Taiwan Semiconductor: Buffett Apparently Fears the Politics (NYSE:TSM).” Seeking Alpha, 13 Apr. 2023, https://seekingalpha.com/article/4593995-taiwan-semiconductor-buffett-apparently-fears-the-politics.

vi Ballentine, Claire. “Car Repossessions Grow as Inflation Slams Consumers.” Bloomberg.com, Bloomberg, 27 Jan. 2023, https://www.bloomberg.com/news/articles/2023-01-27/car-repossessions-grow-as-inflation-slams-consumers.