April 2024 – Economic and Market Update

EXECUTIVE SUMMARY

- Inflation is not cooperating with the Federal Reserve target of 2% annualized Core CPE and is unlikely to get there in an orderly fashion.

- Prioritizing credit management and duration risk in an uncertain interest rate environment.

- Consumers remain strong spenders, according to Visa, and consumer sentiment is at an inflection point according to the Consumer Sentiment Index.

- Some interesting tax law changes for 2024, such as 529 Plan to Roth conversions.

The 1st quarter of 2024 generally saw the continuation of trends from 2023. The “magnificent 7” stocks (Apple, Amazon, Google, Meta, Microsoft, Nvidia, and Tesla) retained their oversize impact on index returns, though not as dramatically. Large cap stock indexes have paced the

markets so far, partially due to the aforementioned 7 stocks. Fixed income is flat to slightly negative on the year. Returns on cash remain positive in a sustained high interest rate environment.

Markets have been coming around to the idea that interest rates will be “higher for longer”, we are experiencing increased volatility as a result. It kind of feels like a see-saw where market sentiment is ambivalent to actual interest policy and moves up or down based on the opinion of the day regarding future interest rate policy. The Federal Reserve rate hike path remains uncertain with forecasters reducing their estimate of rate reductions in 2024.

Geo-political tensions remain a significant concern with multiple wars occurring around the world. Globally, economic activity is cooling, particularly in Germany, the United Kingdom, China, and Japan. At this point Germany is most likely in a recession according to recent data. That said, in mid-2023 there were headlines saying the United States was likely in a recession, which never materialized.

THE FEDERAL RESERVE

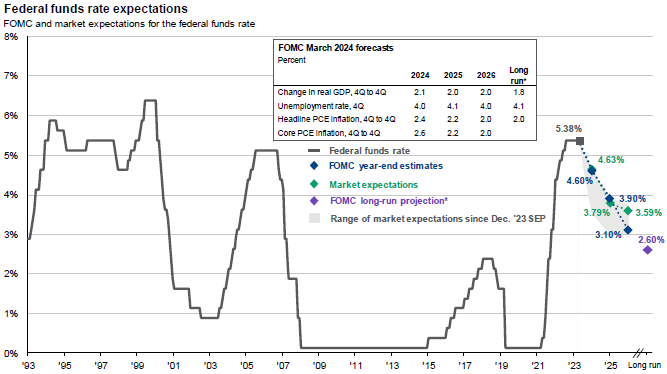

Expectations rarely match reality. As you can see in the preceding graph there is a noticeable glide path down from current interest rates on the far-right side of the graph marked in color coding. Market expectations are in green and Fed expectations are in blue and purple.

If you look from left to right, you see actual interest policy covering the past 40 years of history. Rate decreases are generally characterized by very steep reduction activity because of something breaking in the economy. The Dot-Com Bust, the Great Financial Crisis, the COVID Pandemic, the breaks are obvious as we have lived through them all. The idea that we are going to experience an ordered rate drawdown feels a bit Pollyanna-esque and out of touch with prior experiences.

The Federal Reserve has historically loathed bringing rates down pre-emptively. On the pro side, they will bring them down in a hurry. On the con side, it will probably be because something broke. “This was supposed to be the year that US inflation rode the last mile down to 2%, letting the Federal Reserve steadily reduce interest rates from a two-decade high. Now those expectations have been dashed.” (Bloomberg)[i]

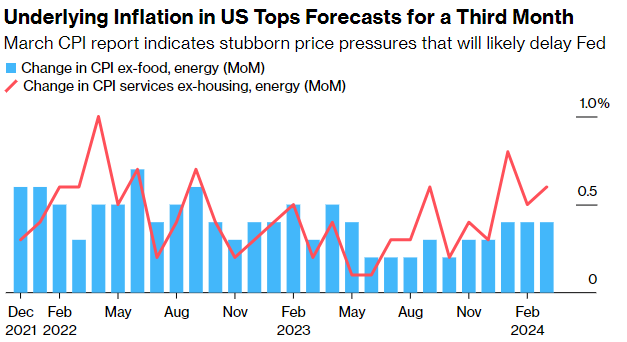

The constant inflation watch has gotten exhausting. The chart above highlights that underlying inflation has exceeded forecasts for the third consecutive month as of March, which implies that inflationary pressures remain stubborn and are not solely driven by the typically volatile food and energy sectors. This trend suggests that the Federal Reserve might face challenges in easing inflationary pressures and could delay the anticipated monetary policy adjustments, such as reducing interest rates. We are in the final stretch here in the U.S., but it is going to be tough getting the rest of the way there. For now, the target for Core CPE remains 2% annualized inflation.

For our fixed income portfolios, we are staying on the shorter side of the duration table. We expect rates to remain high and do not want to get burned if there are interest rate increases instead of the decreases markets are clamoring for. We are also reducing high-yield exposure. As mentioned above, the Fed reduces rates quickly when things break. Typically, when the economy breaks companies go belly-up. Managing credit risk is a prudent move in volatile environments. Our method of doing this is through implementing a risk factor framework – managing duration, credit, and sector exposures.

CONSUMERS and CREDIT CARDS

It is earnings season. The big reveal is here as to how the 1st quarter of 2024 went for all of the publicly traded companies in the U.S. We know at this point that GDP growth has slowed to an annual rate of 1.6% coming in well below the 4th quarter growth rate of 3.4%. This was a surprise as early expectations were for a reading in the mid 2% range.[ii],[iii]

We also know that Visa performed well and received a healthy stock bump as a result. Visa CFO Chris Suh made the following statement post-earnings conference call, “Consumer spend across all segments from low-to-high spend has remained relatively stable. Our data does not indicate any meaningful behavior change across consumer segments”. We will restate his quote for clarity – people are using their credit cards and are not meaningfully pulling back on what they

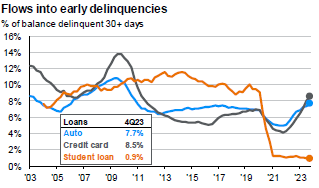

put on their credit cards.[iv] They also are not paying off those credit cards quite as frequently according to the following graph.

Overrall, rising delinquency rates in auto and credit card loans could be indicative of economic pressures finally facing consumers. Student loans remain an outlier even though payments on student loans resumed in October of 2023.[v]

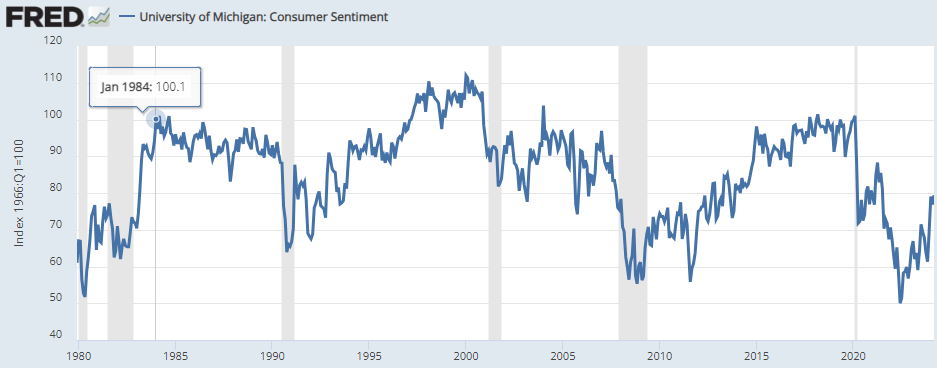

The graph above illustrates the Consumer Sentiment Index maintained by the University of Michigan. Overall, the last three years on the graph depict a significant disruption to consumer sentiment due to the pandemic, followed by an uneven and not yet complete recovery.There has been a signficant increase in the most recent months with what appears to be a potential inflection point at the most recent reading.

The focus on the consumer is not trivial. In the U.S. private consumption of goods and services accounted for 68.2% of nominal GDP as of December 2023. Disheartened and non-spending consumers are disastrous for the economy. It is hard to draw too much of a conclusion from these two charts but it appears the consumer is weakening with more people entering early delinquency on their obligations. At the same time, consumers are not recognizing the precarious position they are putting themselves in and are still spending robustly. Time will tell.[vi]

AN INTERNATIONAL UPDATE

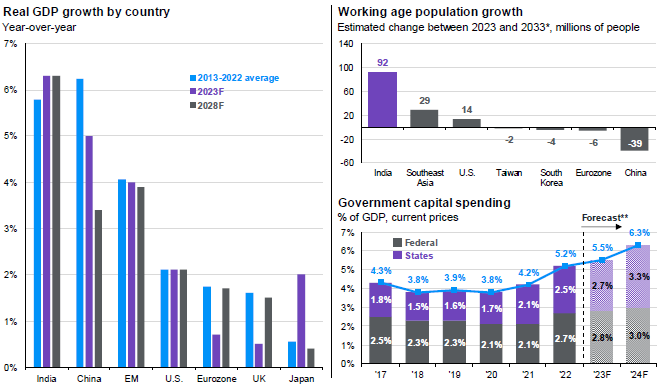

Things are not going well around the world economically, for the most part. The United Kingdom, Japan, and Germany have all made comments alluding to a second straight quarter of economic contraction. By some definitions this would see a recession declared in all three countries if the situation does not improve. India is doing very well and China is scuffling. The hand-off from China to India of the title “World’s Fastest Growing Major Economy” looks set to be etched in stone.[vii]

Emerging market economies, such as India, outperformed their developed market counterparts so far this year. Attractive valuations and robust economic growth prospects are the driving factors. As you can see in the graph below, India may finally be ready to step into the limelight. Forecast growth moving forward is strong. The graph in the bottom right is forecast spending by the Indian government moving forward.

FINANCIAL PLANNING

A few interesting tax law changes have taken effect this year which savers should be aware of:

We have briefly mentioned this before in discussing changes (improvements) to 529 College Savings Accounts. Surplus balances in 529 education savings accounts are eligible for tax-free transfer to Roth IRAs, with the provision that such transfers are subject to a lifetime maximum of $35,000. The amount transferred in any given year cannot surpass the annual contribution limit for Roth IRAs, set at $7,000 for the year 2024. Additionally, this option is only available for 529 accounts that have been active for over 15 years. Is this the solution to the tax trap you are in if you have $300k sitting in a 529 plan and no prospective college students? No, but it is still a nifty trick and can certainly help unwind 529 accounts with small amounts of leftover funds.

Holders of Roth 401(k) accounts are no longer obligated to withdraw required minimum distributions, aligning this regulation with the existing policy for Roth IRA owners. This provides Roth 401k owners with the option to maintain their existing Roth 401k if it is in their best interest to do so, versus rolling out of the employer plan to a Traditional Roth IRA.

HSA contribution limits have been increased. This is one of those areas of tax law that is hard to keep track of as it is not as widely used of a provision as it should be. If you have an HSA compatible health plan you can now contribution $4,150/year for an individual and $8,300/year for a family. If you are one of the lucky ones with an HSA, check to make sure you will take full advantage of the contribution limits.

Our commitment to guiding you through these evolving economic conditions remains unwavering. We encourage you to reach out with any questions or concerns as we navigate these changes together.

DISCLOSURE

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any company names noted herein are for educational purposes only.

All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy. All economic and performance data is historical and not indicative of future results. Market indices discussed are unmanaged. Investors cannot invest in unmanaged indices. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards.

Investing in securities in emerging markets involves special risks due to specific factors such as increased volatility, currency fluctuations and differences in auditing and other financial standards. Securities in emerging markets are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments.

An index is a statistical measure of change in an economy or a securities market. In the case of financial markets, an index is an imaginary portfolio of securities representing a particular market or a portion of it. Each index has its own calculation methodology and is usually expressed in terms of a change from a base value. Thus, the percentage change is more important than the actual numeric value. An investment cannot be made directly into an index.

Investing in fixed income securities involves credit and interest rate risk. When interest rates rise, bond prices generally fall. Investing in commodities may involve greater volatility and is not suitable for all investors. Investing in a non-diversified fund that concentrates holdings into fewer securities or industries involves greater risk than investing in a more diversified fund. The equity securities of small companies may not be traded as often as equity securities of large companies so they may be difficult or impossible to sell. Neither diversification nor asset allocation assure a profit or protect against a loss in declining markets. Past performance is not an indicator of future results.

Sean P. Storck and Steven W. Pollock are registered representatives with and securities and Retirement Plan Consulting Program advisory services offered through LPL Financial, a Registered Investment Advisor. Member FINRA/SIPC. Financial Planning offered through Reason Financial, a state Registered Investment Advisor. Investment advice offered through Merit Financial Group, LLC an SEC Registered Investment Advisor. Merit Financial Group and Reason Financial are separate entities from LPL Financial. Tax related services offered through Reason Tax Group. Reason Tax Group is a separate legal entity and not affiliated with LPL Financial. LPL Financial does not offer tax advice or tax related services. Sean P. Storck CA Insurance Lic#OF25995 and Steven W. Pollock CA Insurance Lic#OE98073

Copyright © 2024 Reason Financial all rights reserved.

[i] Smith, Molly, and Steve Matthews. “Why Is Us Inflation Still High? Blame Powell Pivot, Housing Shortage.” Bloomberg.Com, Bloomberg, 17 Apr. 2024, www.bloomberg.com/news/articles/2024-04-17/inflation-s-stubborn-start-to-2024-blamed-partly-on-powell-pivot?srnd=economics-inflation-and-prices.

[ii] Mataloni, Lisa. “Gross Domestic Product, First Quarter 2024 (Advance Estimate).” News Release, Bureau of Labor Statistics, 25 Apr. 2024, www.bea.gov/sites/default/files/2024-04/gdp1q24-adv.pdf.

[iii] Cox, Jeff. “GDP Growth Slowed to a 1.6% Rate in the First Quarter, Well below Expectations.” CNBC, CNBC, 25 Apr. 2024, www.cnbc.com/2024/04/25/gdp-q1-2024-increased-at-a-1point6percent-rate.html.

[iv] Saini, Manya, and Pritam Biswas. “Visa Results Beat Estimates on Resilient Consumer Spending | Reuters.” Finance, Reuters, 23 Apr. 2024, www.reuters.com/business/finance/visas-profit-rises-strong-consumer-spending-2024-04-23/.

[v] “Restarting Student Loan Payments.” Federal Student Aid, studentaid.gov/manage-loans/repayment/prepare-payments-restart. Accessed 29 Apr. 2024.

[vi] “United States Private Consumption: % of GDP.” Key Information about United State Private Consumption: % of GDP, CEIC, 1 Dec. 2023, www.ceicdata.com/en/indicator/united-states/private-consumption–of-nominal-gdp.

[vii] Choe, Stan, and Christopher Rugaber. “Recession Has Struck Some of the World’s Top Economies. the US Keeps Defying Expectations.” AP News, AP News, 15 Feb. 2024, apnews.com/article/recession-japan-united-kingdom-economy-consumer-spending-31e145cfe5168e10eaecb0614fcc8458#:~:text=The%20US%20keeps%20defying%20expectations,-1%20of%203&text=NEW%20YORK%20(AP)%20%E2%80%94%20As,final%20three%20months%20of%202023.