January 2024 – Economic and Market Update

EXECUTIVE SUMMARY

- 2023 turned in a good performance on the markets despite a great deal of hand wringing regarding the risks of a recession.

- Potentially peak interest rates require a look at how to handle conservative investments, particularly, Certificates of Deposit (CDs).

- New year, new RMD rules. A look at who needs to take an RMD and when.

As we reflect on 2023, initial fears of a tumultuous year were unfounded. Instead, we saw an economy that not only held its ground but also demonstrated remarkable growth amidst moderating inflation rates. However, a slight uptick in inflation towards the end of the year suggests we should remain vigilant. This recent development dampens prospects for early 2024 interest rate reductions, thereby reinforcing our “higher for longer” approach.

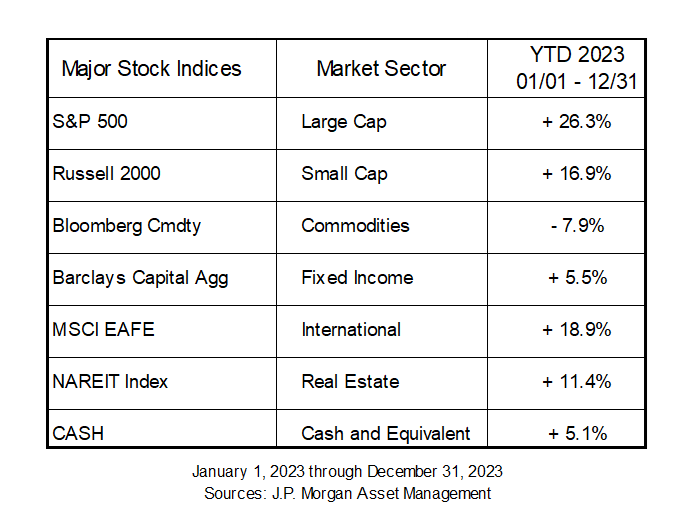

Despite the uncertainties, a soft landing now seems more plausible than it did at the close of 2022, thanks to the economy’s unexpected resilience. The S&P 500, propelled by the standout performance of its top 10 mega-cap stocks, emerged as the year’s top performer. Conversely, commodities were the lone sector to face a downturn. Fixed income markets found their footing, showing recovery from a challenging 2022.

Source: FactSet, Standard & Poor’s, J.P. Morgan Asset Management, Guide to the Markets – U.S. Data are as of December 31, 2023

It truly was a strange year. Concentration in the S&P 500 was at the highest point in its history. It is easy to get caught up in the performance return, but it is prudent to try to hedge against the risk over-concentration creates. With 86% of the S&P 500 return in 2023 generated by just 10 stocks, you have to get creative to diversify. In fact, prior to the recovery at the end of the year, these top stocks were the only reason the index was in positive territory. We remain committed to finding ways to limit exposure via more active management.[i],[ii]

2024 PROGNOSTICATIONS

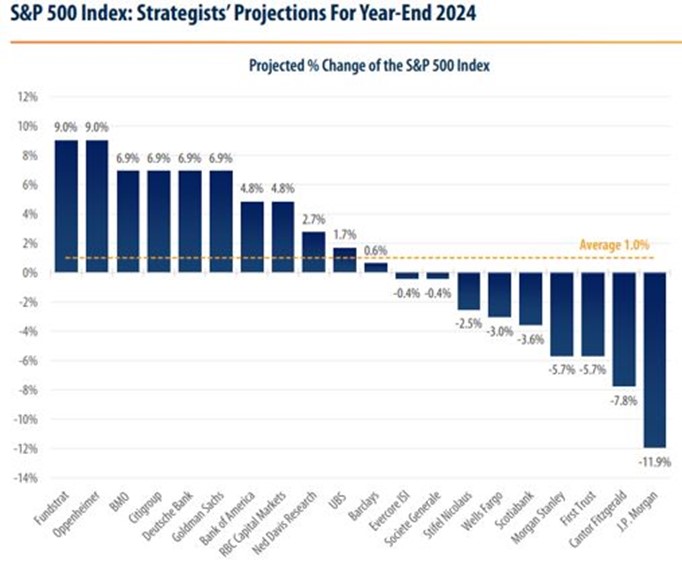

The new year brings a spectrum of market forecasts from asset managers. The graph below displays a range of S&P 500 index predictions, with the most optimistic forecasting 9% growth and the most pessimistic an 11.9% loss.

Sources: Bloomberg, First Trust Advisors

A sampling of various managers’ commentary offers insight into these projections:

HSBC – “If we had to find a title for our outlook for 2024, we would call it – quite boringly – ‘more of the same’… We see 2024 as being much the same with the market flipflopping between ‘Goldilocks’ and ‘Reverse Goldilocks’.”[iii]

Fidelity – “Our base case for 2024 is a cyclical recession. Resilience driven by fiscally supported consumers and companies has been the biggest surprise of 2023, but barring something extraordinary, next year we expect to see the economy finally turn lower.”[iv]

Franklin Templeton – “We favor a tilt toward fixed income over equities given current valuation and macroeconomic considerations. Yields are attractive and a tilt to quality is favored at this stage of the economic cycle as interest rates are near peak levels, with inflation and economic growth softening.”[v]

The easiest way to sum it up is that there are no exuberant expectations for 2024. We continue to emphasize a diversified and balanced risk allocation versus overweighting to growth. This limits exposure to the top 10 stocks which performed so well in 2023, but it should help reduce risks in case the recession we have all been expecting finally comes around. A soft-landing looks more likely, but valuations present a risk in the near term.

CD’s, INTEREST RATES, AND OTHER OPTIONS

In the realm of interest rates, the Federal Reserve’s future course is a subject of widespread speculation. Whether rates will climb, descend, or stabilize at the current 5.25% to 5.5% range is a crucial question for investors. The consensus leans towards rates either plateauing or decreasing, suggesting we might be at the apex of the interest rate cycle. This pivotal moment in monetary policy brings us to a crossroads regarding cash management strategies, especially concerning Certificates of Deposit (CDs).

Source: Bloomberg, FactSet, Federal Reserve, Robert Shiller, J.P. Morgan Asset Management

Guide to the Markets – U.S. Data are as of December 31, 2023

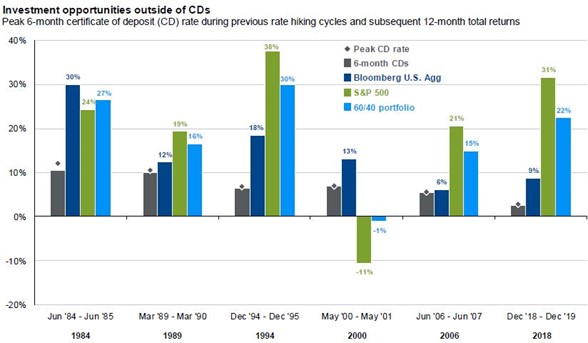

Historically, as depicted in the accompanying graph, there has been a consistent trend where pivoting away from CDs following a peak in interest rates has yielded more lucrative opportunities in other asset classes. This trend has been especially pronounced in the subsequent twelve months following such a peak.

Every situation is different, but assuming there is a longer-term time horizon for the cash, looking at an alternative is a good idea. For example, the dark blue column above depicts the Bloomberg U.S. Aggregate bond fund. This is a good placeholder from a more conservative standpoint if you want to move out of cash. This is not a broad recommendation; it is a food-for-thought item.

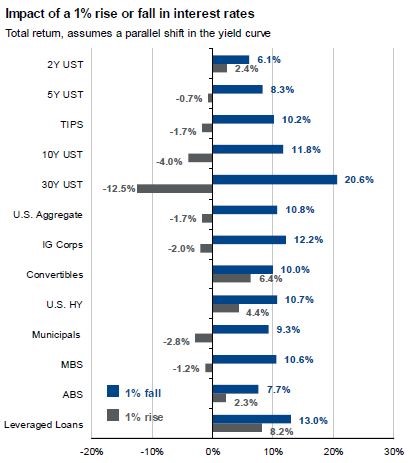

When interest rates peak, the reduction in value of a bond in a rising interest rate environment begins to wane due to decreased duration risk. Other risks remain, such as default risk. However, if we enter a decreasing interest rate environment the bonds inside the portfolio generally become worth more as they have a higher interest rate yield relative to new bonds entering the marketplace. The impact of a 1% decrease/increase on a variety of bond types can be seen below.

Source. Bloomberg, FactSet, Standard & Poor’s, U.S. Treasury, J.P. Morgan Asset Management. Sectors show above are provided by Bloomberg unless otherwise noted. Guide to the Markets – U.S. Data are as of December 31,2023

The aggregate bond market is in the middle of the graphic. An increase of 1% in interest rates has a -1.7% impact on the U.S. Aggregate as a whole. A decrease of 1% in interest rates can provide up to 10.8% in capital appreciation on the U.S. Aggregate as a whole. Every investment option carries risk, but we are happy to discuss what to do with your conservative investments as we appear to be reaching peak interest rates.

INFLATION

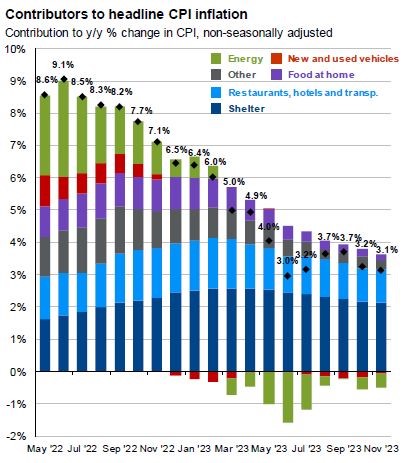

Inflation has presented a complex narrative over the past year. Despite trending downwards for most of 2023, the final inflation reading in December (not pictured in the graph below) showed an increase to 3.4%. This fluctuation raises questions about the potential persistence of inflationary pressures. A recent Financial Times article by Mohamed El-Erian sheds light on this issue, suggesting that we might be approaching the final phase of the inflation battle, albeit with complexities ahead; “the recent data serves as a surprisingly early warning of the long and winding road ahead in the last mile of the inflation battle”.[vi]

Source: BLS, FactSet, J.P. Morgan Assets Management. Guide to the Markets – U.S. Data are as of December 31, 2023

Necessary expenses, particularly shelter/housing, continue to feel the brunt of these inflationary trends. The distinction between disinflation (a slowdown in the rate of inflation) and deflation (a decrease in the general price level) is important. We are currently experiencing disinflation, not deflation. This distinction is useful in understanding what the Federal Reserve is trying to accomplish. Prices from the good old days of 4 years ago are not likely to return, unless we experience serious economic shocks triggering a deflationary environment. Something akin to the 2008/09 financial crisis, which they are trying to avoid.

Inflation ticking up in December along with the recent 4th Quarter GDP release measuring 3.3% suggests we will have a careful Federal Reserve. It looks unlikely they will start reducing rates in the first part of 2024.On the plus side, wage growth (4.3% as of November) is currently higher than inflation. Positive real wage growth will help to ease the pain experienced when buying groceries, albeit very slowly. A long and winding road it will be.

THE PLANNING CORNER: RETIREMENT CONTRIBUTIONS AND RMD’s

As we approach tax season, it’s important to be proactive with your retirement planning and tax savings. The contribution limits for IRAs/ROTHs and 401Ks/403Bs have been updated for 2024, providing an opportunity to maximize your retirement savings and potentially reduce your taxes.

2024 brings an increased IRA/ROTH limit of $7,000, with a catch-up contribution of $1,000 for individuals over 50. Similarly, the 401k/403b limit has been raised to $23,000, with a $7,500 catch-up for those over 50.

Required Minimum Distributions (RMDs) have been recalculated for the year, making it a good time to evaluate your distribution strategies. If you are charitably inclined, one tax-efficient method is using Qualified Charitable Distributions, where you directly distribute funds from your IRA to a qualified charity, reducing the taxable amount of your RMD. This option is available if you are 70.5 years of age. As the RMD age has crept up in recent years, this part of the tax code has stayed the same.

For those navigating the nuances of RMDs under either Secure Act 1.0 or Secure Act 2.0, remember that the rules vary based on your age. If you turned 72 in 2023, your first RMD is due for TY 2024, with a deadline of April 1, 2025. For those who turned 73 in 2023, you are subject to the Age 72 RMD rules and should ensure compliance for 2023 and 2024. If you turned 71 in 2023, talk to us next year.

As we continue into 2024, our commitment to guiding you through these evolving economic conditions remains unwavering. We encourage you to reach out with any questions or concerns as we navigate these changes together.

DISCLOSURE

All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy. All economic and performance data is historical and not indicative of future results. Market indices discussed are unmanaged. Investors cannot invest in unmanaged indices. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards.

Investing in securities in emerging markets involves special risks due to specific factors such as increased volatility, currency fluctuations and differences in auditing and other financial standards. Securities in emerging markets are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments.

An index is a statistical measure of change in an economy or a securities market. In the case of financial markets, an index is an imaginary portfolio of securities representing a particular market or a portion of it. Each index has its own calculation methodology and is usually expressed in terms of a change from a base value. Thus, the percentage change is more important than the actual numeric value. An investment cannot be made directly into an index.

Investing in fixed income securities involves credit and interest rate risk. When interest rates rise, bond prices generally fall. Investing in commodities may involve greater volatility and is not suitable for all investors. Investing in a non-diversified fund that concentrates holdings into fewer securities or industries involves greater risk than investing in a more diversified fund. The equity securities of small companies may not be traded as often as equity securities of large companies so they may be difficult or impossible to sell. Neither diversification nor asset allocation assure a profit or protect against a loss in declining markets. Past performance is not an indicator of future results.

Sean P. Storck and Steven W. Pollock are registered representatives with and securities and Retirement Plan Consulting Program advisory services offered through LPL Financial, a Registered Investment Advisor. Member FINRA/SIPC. Financial Planning offered through Reason Financial, a state Registered Investment Advisor. Investment advice offered through Merit Financial Group, LLC an SEC Registered Investment Advisor. Merit Financial Group and Reason Financial are separate entities from LPL Financial. Tax related services offered through Reason Tax Group. Reason Tax Group is a separate legal entity and not affiliated with LPL Financial. LPL Financial does not offer tax advice or tax related services. Sean P. Storck CA Insurance Lic#OF25995 and Steven W. Pollock CA Insurance Lic#OE98073

[i] Santos, Gabriela, and Mary Park Durham. “Have Other Equity Market Returns Been as Concentrated as Those in the U.S.?” On the Minds of Investors, 29 Nov. 2023, am.jpmorgan.com/us/en/asset-management/protected/adv/insights/market-insights/market-updates/on-the-minds-of-investors/have-other-equity-market-returns-been-as-concentrated-as-those-in-the-us/.

[ii] Equity Index Concentration and Portfolio Implications, Goldman Sachs Asset Management, Nov. 2023, www.gsam.com/content/gsam/us/en/institutions/market-insights/gsam-insights/2023/equity-index-concentration-and-portfolio-implications.html.

[iii] Potter, Sam. “Here’s (Almost) Everything Wall Street Expects in 2024.” Bloomberg.Com, Bloomberg, Jan. 2024, www.bloomberg.com/graphics/2024-investment-outlooks/.

[iv] Potter, Sam. “Here’s (Almost) Everything Wall Street Expects in 2024.” Bloomberg.Com, Bloomberg, Jan. 2024, www.bloomberg.com/graphics/2024-investment-outlooks/.

[v] Potter, Sam. “Here’s (Almost) Everything Wall Street Expects in 2024.” Bloomberg.Com, Bloomberg, Jan. 2024, www.bloomberg.com/graphics/2024-investment-outlooks/.

[vi] El-Arian, Mohamed. “A Warning Shot Over the Last Mile In the Inflation Battle.” A Warning Shot over the Last Mile in the Inflation Battle, Financial Times, 15 Jan. 2024, www.ft.com/content/497499b1-0e9f-4215-a536-ecd483ad42b9.