October 2019 – An Economic and Market Update

EXECUTIVE SUMMARY

- Market performance has been strong, but volatility has made it hard to rest easy.

- Trade policy uncertainty is taking a toll on global and domestic growth while we wait and see what decisions are finally made.

- The Federal Reserve is taking an accommodative monetary policy stance to stimulate the economy; keeping wages and employment high.

- Our expectation is for challenging economic circumstances to provide the opportunity for those who plan accordingly.

LOOKING BACK

“We are into the 11th year of this economic expansion, and the baseline outlook remains favorable.” Fed Chair Jerome Powell began his most recent press conference with a generally positive statement about

“We are into the 11th year of this economic expansion, and the baseline outlook remains favorable.” Fed

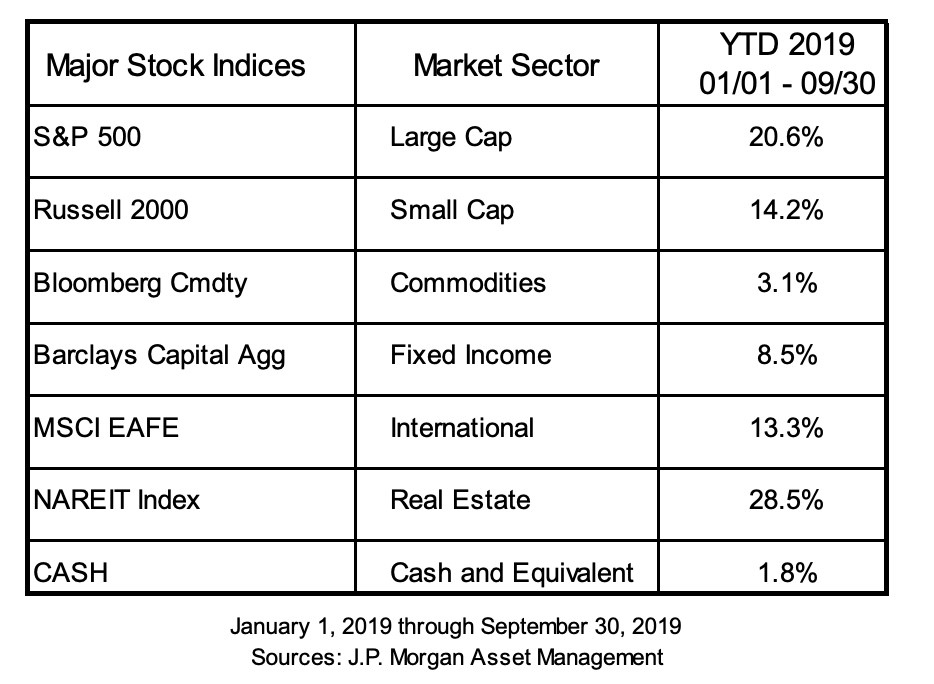

Chair Jerome Powell began his most recent press conference with a generally positive statement about where we are today. Market performance Year-to-Date is in line with his public address as all asset classes have held steady. Real Estate Investment Trusts have led the way with the S&P 500 following in a distant second with the remaining asset classes somewhere after. Cash has performed the same as it did in 2018 at 1.8% but, unlike last year, it is the worst performer of all. Asset allocation strategies following Modern Portfolio Theory have generally performed in the middle of the pack depending on the growth tilt for a given strategy from Conservative to Growth.i

Volatility in the market has been a constant companion of ours in the last 3 months, much of it caused by the content of the President’s tweets. Interestingly, a bit of research has been completed on whether these tweets have any impact on the market. The “Volfefe Index”, humorously created by analysts at JP Morgan, and research by Bank of America, have found that there is statistical relevance to market movement around the tweets. “Since 2016, days with more than 35 tweets by Trump have seen negative returns. Days with less than 5 tweets have seen positive returns – statistically significant,” according to Savita Subramanian, Bank of America’s chief equity strategist. This tidbit of information tells a broader story of how economically relevant issues such as trade policy can stir or calm uncertainty based on the public narrative. In fact, it is the tweets on trade which have garnered the most volatility, something you have probably noticed.ii, iii

THE TRADE WARS

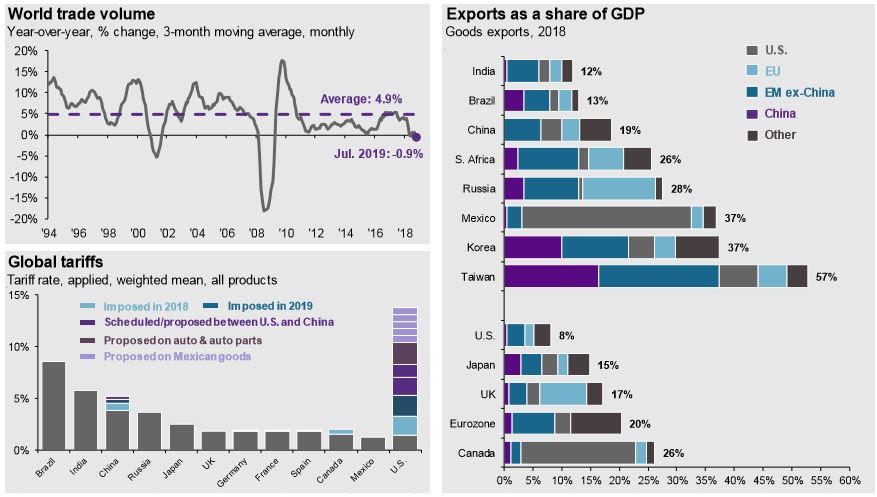

The graph in the top left is a strong statement for how global trade has been impacted throughout the tariff period. Trade has generally stalled, and most recently contracted, as protectionist trade policy has been enacted. Policy and tariffs play some part in this slowdown along with the slowdown in global economic growth. In the most recent Federal Reserve meeting minutes from September, the decrease in net exports from the U.S. with the world resulted in a “drag of about ¾ percentage point on real GDP growth in the second quarter”. This is a real issue, which helps to explain why President Trump’s tweets on the topic garner so much attention and increase market volatility.iv

As you can see from the “Global tariffs” graph on the bottom left, prior to the trade war the US was on the low end of tariff protections. Brazil, India, and China have historically had the highest level of tariffs. The grey, teal and blue areas denote tariffs now in force. The various purple colors are proposed increases in protectionist policies not yet in place. In a short time, the U.S. has gone from a mostly free-trade country to a rapidly protectionist one. This issue in and of itself is unlikely to bring the U.S. to a recession, but when combined with the following observation, again by the Federal Reserve, that “growth slowed sharply in Europe…Growth also slowed in China and India. Recent indicators suggested widespread weakness in manufacturing abroad…”, it becomes concerning.v

We liken the situation to setting up a stack of dominos and then knocking the first one down which in turn knocks the next and then the next. The last domino in the line does not see what is coming until the domino just in front of it finally tips over, and for just a split second the reality of the pending fall is clear and then finally it falls also. This scenario looks increasingly possible.

To some degree this can be a self-fulfilling prophecy:

“Our business contacts around the country have been telling us that uncertainty about trade policy has discouraged them from investing in their businesses.”

Fed Chair Jerome Powell on September 18, 2019

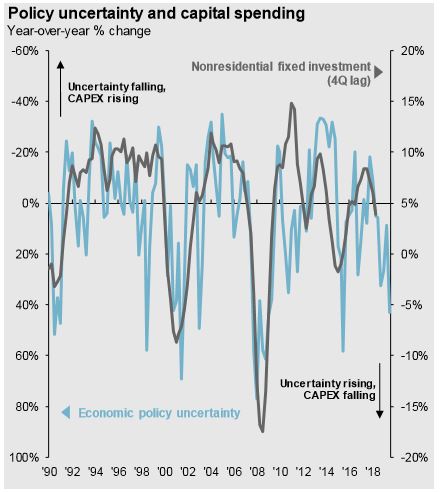

This is the last thing we want to hear. Uncertainty slows down the pace of everything and it is showing. As is visible below, policy uncertainty and investment decisions have a positive correlation.

This means that certainty drives investment higher and uncertainty pushes investment lower. Over the last year, uncertainty increased and capital expenditures have fallen. With falling capital expenditures and slower business re-investment we are looking closely at whether this begins to affect hiring decisions.

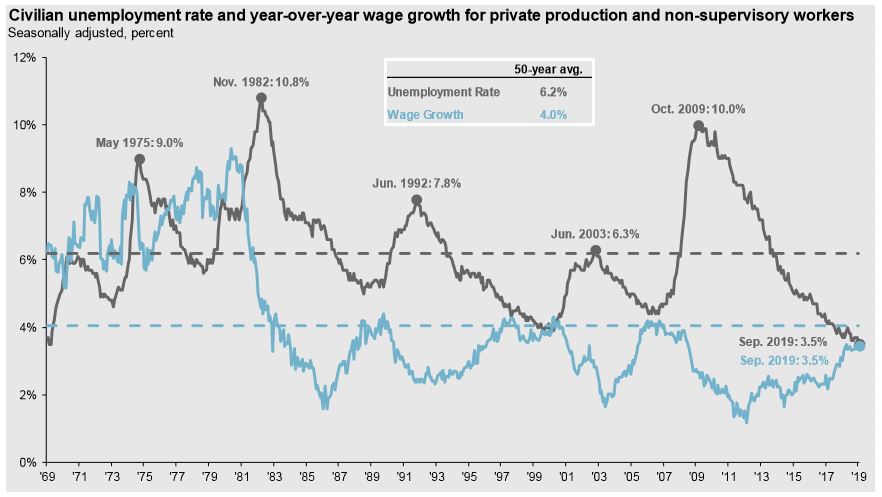

The employment market in the United States is very strong right now. Our general sense from reading policy statements by the Federal Reserve leads us to believe that a part of the loosening of monetary policy is to keep this trend moving forward. Fed Chair Jerome Powell spoke directly to this issue saying, “Participation in the labor force by people in their prime working years has been increasing. And wages have been rising, particularly for lower-paying jobs. People who live and work in low and middle-income communities tell us that many who have struggled to find work are now getting opportunities to add new and better chapters to their lives. This underscores, for us, the importance of sustaining the expansion so that the strong job market reaches more of those left behind.” vii

To sum up, everything we stated above as concisely as possible, what we believe is this: The Federal Reserve is very concerned about the effects of uncertainty and global instability on the investment and hiring decisions of U.S. firms. The long recovery we have been in is providing wage growth and jobs to the lower-income wage groups, and in turn, supporting consumption which is the largest component of U.S. GDP. In order to maintain the expansion for as long as possible, they are becoming more accommodative in their approach, recently cutting interest rates again by a quarter-point. The more accommodative monetary policy stance of the Fed will likely prolong the expansion but we should expect growth to continue to slow.

WHAT IS HAPPENING IN EUROPE

Answering the question of what is going on in Europe is challenging. Germany has not officially tipped into recession yet but the most recent estimate from the Bundesbank, the German Central Bank, is that “German economic output could have decreased slightly in the third quarter of 2019.” If this is the case then they will officially be in a recession with two consecutive quarters of slightly negative growth. The German stock market, the DAX, peaked in January 2018, fell roughly 24% and has slowly recovered although it still sits short of its high nearly 2 years ago. Germany is unique compared to the U.S. in that it is a manufacturing and export country. 47.3% of German GDP comes from export activities whereas only 12.1% of U.S. GDP is generated in a similar fashion. This makes them far more sensitive to trade shocks. With the escalated trade tensions between the U.S. and China impacting global markets and Brexit happening on their doorstep this has not boded well for Germany. For that matter, France has begun to slow as well along with the broader Eurozone. viii, ix

Our favorite graph is back and looks much like it did last quarter. The far-right column is the current state of manufacturing by region across the globe. As a reminder, readings above 50 indicate expansion and below 50 retractions. Developed countries apart from the U.S., Canada and UK slowed over the last quarter. The Eurozone is in the doldrums. China’s economic slowdown has worsened somewhat, although its manufacturing has held par. The silver lining is found in the continued tenacity of the world’s largest economies (U.S. and China) to hold the course. However, this continues to affirm our concern that we may be the last domino in the line. x

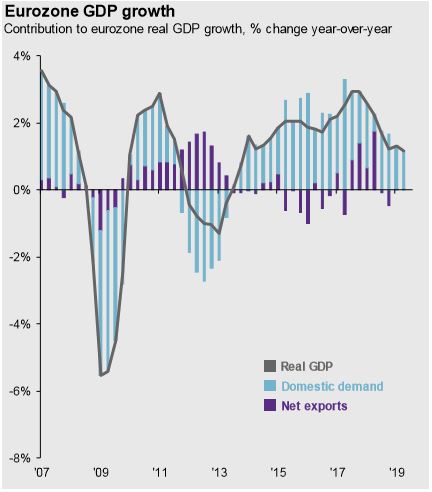

As you can see clearly illustrated on the next page, the Eurozone as a whole has experienced a continually slower pace of growth over the last 2 years. The current forecast for the U.S. is beginning to look similar to real GDP growth forecast to continue slowing in the U.S. for the second half of 2019 as business spending slows along with government spending. Whether or not the slowness becomes a full-blown recession is up for debate, although as we remarked earlier our belief is that the Federal Reserve will be as accommodating as possible. Ray Dalio, a well-known investor, and hedge fund billionaire, recently stated in an interview that he does not see an economic crash on the horizon, but rather a “great sag”. xi

Guide to the Markets – U.S. Data are as of September 30, 2019

Sag is not really a generally accepted financial term, but it may end up being a great way to describe where the global economy is. Negative interest rates, low levels of productivity growth, slow GDP growth, accomodative monetary policy, and low inflation: all of these things point to a downshift in expectation for economic and market performance while slack is worked out of the system.

THE PLANNING CORNER

Every slowdown provides an opportunity. That opportunity may come in the form of continued dollar-cost averaging into retirement accounts allowing you to have systematically lower buy-in points on invested dollars over time. It may come in saving up today to be well-positioned to buy a home or other property should prices turn south. Our expectation is that a continued low-interest-rate environment will provide buying opportunities for people who plan appropriately.

Now is a great time to review your long-term financial objectives and prepare for successful outcomes through what will likely be average-to-poor economic times.

We are here to help you make rational, informed and well-reasoned decisions, and we thank you for your continued trust and support. Your input is always welcome, and we ask that you contact us with any questions or concerns.

DISCLOSURE

All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. All economic and performance data is historical and not indicative of future results. Market indices discussed are unmanaged. Investors cannot invest in unmanaged indices. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards.

Investing in securities in emerging markets involves special risks due to specific factors such as increased volatility, currency fluctuations and differences in auditing and other financial standards. Securities in emerging markets are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments.

An index is a statistical measure of the change in an economy or a securities market. In the case of financial markets, an index is an imaginary portfolio of security representing a particular market or a portion of it. Each index has its own calculation methodology and is usually expressed in terms of a change from a base value. Thus, the percentage change is more important than the actual numeric value. An investment cannot be made directly into an index.

Investing in fixed income securities involves credit and interest rate risk. When interest rates rise, bond prices generally fall. Investing in commodities may involve greater volatility and is not suitable for all investors. Investing in a non-diversified fund that concentrates holdings into fewer securities or industries involves greater risk than investing in a more diversified fund. The equity securities of small companies may not be traded as often as equity securities of large companies so they may be difficult or impossible to sell. Neither diversification nor asset allocation assures a profit or protect against a loss in declining markets. Past performance is not an indicator of future results.

Securities offered through Avantax Investment ServicesSM, Member FINRA, SIPC. Investment Managed Solutions (IMS) Platform programs and services offered through Avantax Advisory ServicesSM. All other investment management and financial planning services are offered through Reason Financial. Reason Financial and Avantax Advisory Services are unaffiliated entities. Insurance services offered through 1st Global Insurance Services, Inc. CA Insurance Steven W. Pollock #OE98073, Sean P. Storck #OF25995, Nicole Albrecht #OF99962.

Copyright © 2019 Reason Financial all rights reserved.

i “Transcript of Chair Powell’s Press Conference Sept. 18, 2019.” Www.FederalReserve.gov, The Federal Reserve, 18 Sept.

2019, www.federalreserve.gov/mediacenter/files/FOMCpresconf20190918.pdf.

ii Alloway, Tracy. “JP Morgan Creates ‘Volfefe’ Index to Track Trump Tweet Impact.” Bloomberg.com, Bloomberg, 8 Sept.

iii Alloway, Tracy. “JP Morgan Creates ‘Volfefe’ Index to Track Trump Tweet Impact.” Bloomberg.com, Bloomberg, 8 Sept.

iv “Transcript of Chair Powell’s Press Conference Sept. 18, 2019.” Www.FederalReserve.gov, The Federal Reserve, 18 Sept.

2019, www.federalreserve.gov/mediacenter/files/FOMCpresconf20190918.pdf.

v “Minutes of the Federal Open Market Committee September 17-18, 2019.” Www.FederalReserve.gov, The Federal Reserve,

9 Oct. 2019, www.federalreserve.gov/monetarypolicy/files/fomcminutes20190918.pdf.

vi “Minutes of the Federal Open Market Committee September 17-18, 2019.” Www.FederalReserve.gov, The Federal

Reserve, 9 Oct. 2019, www.federalreserve.gov/monetarypolicy/files/fomcminutes20190918.pdf.

vii “Transcript of Chair Powell’s Press Conference Sept. 18, 2019.” Www.FederalReserve.gov, The Federal Reserve, 18 Sept.

2019, www.federalreserve.gov/mediacenter/files/FOMCpresconf20190918.pdf.

viii Central Intelligence Agency, Central Intelligence Agency, 1 Feb. 2018, https://www.cia.gov/library/publications/the-world- factbook

ix Khan, Yusuf. “Germany’s Economy May Have Already Slumped into Recession, Its Central Bank Says | Markets Insider.” Business Insider, Business Insider, 21 Oct. 2019, markets.businessinsider.com/news/stocks/german-economy-may-be-in- recession-bundesbank-says-2019-10-1028615602.

x Bradsher, Keith. “China’s Economic Growth Slows as Challenges Mount.” The New York Times, The New York Times, 18

Oct. 2019, www.nytimes.com/2019/10/17/business/china-economic-growth.html.

xi Keown, Callum. “Why the Bull Market Won’t End with a Typical Crash, Says Hedge Fund Billionaire Ray Dalio.” MarketWatch, 19 Oct. 2019, www.marketwatch.com/story/why-the-bull-market-wont-end-with-a-typical-crash-says-hedge- fund-billionaire-ray-dalio-2019-10-18?siteid=yhoof2&yptr=yahoo.