April 2018 – An Economic and Market Update

Quarterly Market Update – April 2018

Executive Summary

- Global markets have sold off amidst a spate of disconcerting news.

- We now live under a new tax regime and early analysis confirms our original assessment that most taxpayers will be better off, with three groups identified as clear winners.

- The trade war with China is generating a lot of headlines but, currently, little of substance. President Teddy Roosevelt has a couple words of advice for President Trump on his approach.

- “Slow is smooth” is the Federal Reserve’s strategy for interest rate increases as we experience full employment and tight labor markets.

Looking Back

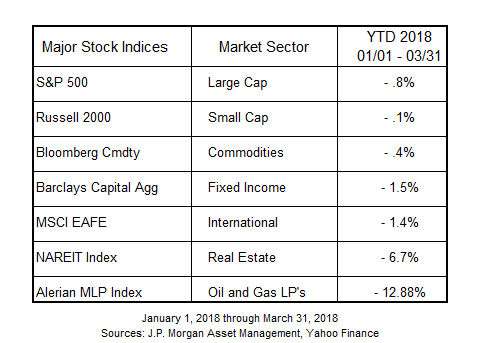

2018 Stalled Out

Stock markets have moved down for the most part this quarter except for Emerging Markets. A variety of explanations can be provided for this as we have seen tariff talks escalate between the United States and China, political uncertainty as we head into mid-term elections, growing hostility with Russia, and interest rate increase policies by the Federal Reserve. The good news is stocks are no longer quite as expensive when measured by their P/E ratio, which is the amount an investor is willing to pay for a dollar of a company’s earnings. In fact, domestic markets have moved in line with their historic averages.

Source: FactSet, FRB, Robert Shiller, Standard & Poor’s, Thomson Reuters, J.P. Morgan Asset Management

Guide to the Markets – U.S. Data are as of March 31, 2018

Since the start of the year three issues have repeatedly come up as areas of concern for our clients. Tax reform had been at the top of the list, up until recently when concern about the trade war with China supplanted it, and finally whether we are in a new real estate bubble.

Tax Reform Update

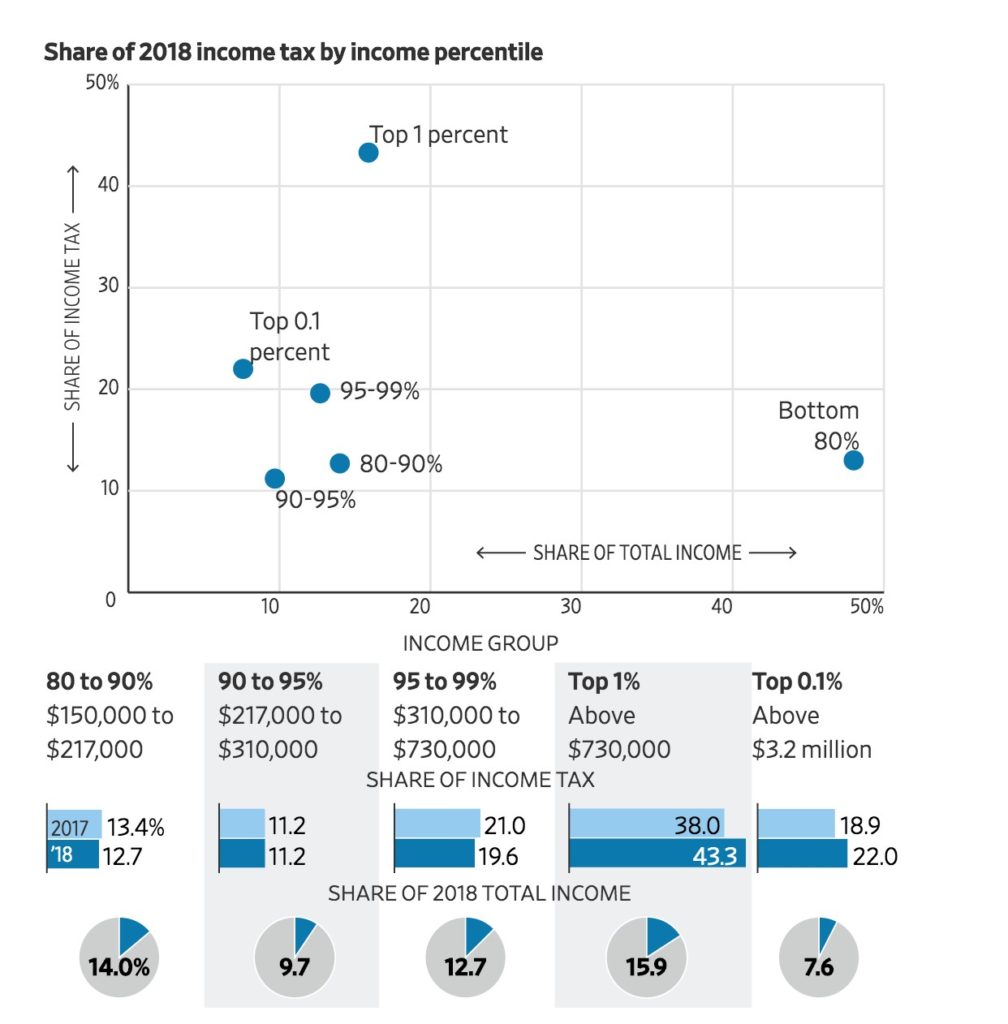

We have now had an entire tax season, hundreds of data points represented by our clients, and more complete outside analysis of how Trump’s Tax Reform is going to impact the collective “us”. Our original assessment that most people will be better off under the new tax regime has been confirmed.

Three significant cohorts of “winners” emerged:

– Households with children, especially those who formerly were not eligible for the Child Tax Credit.

– Taxpayers subject to Alternative Minimum Tax (AMT) who no longer will be.

– Small business owners such as musicians, restaurateurs, landscapers, and more broadly any small business owner benefiting from the new Section 199A deduction.

Most others will benefit, but not to the extent of the three groups listed above. Those who will be worse off are unlikely to be affected to such an extent that it would be detrimental to their current standard of living.

Source Note: Income ranges are rounded. The top 1% includes the top .1%.

Source: Tax Policy Center

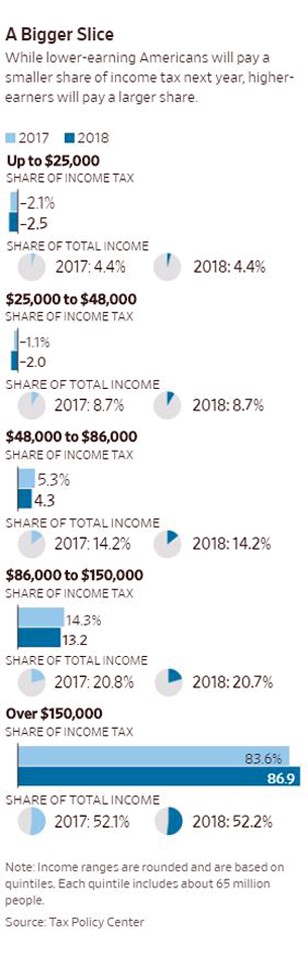

Additionally, it appears tax reform will make the tax system more progressive rather than less. A progressive tax system is one in which tax rates rise as taxable income rises, leading to higher income taxpayers being responsible for a greater share of income taxes than those at the lower end of the spectrum. The top quintile of taxpayers will see their share of income taxes rise while the four other quintiles will see their respective share drop.

The bottom 40% of taxpayers will see their refunds increase significantly due to the expanded Child Tax Credit. The negative income tax paid by the two lowest quintiles is due to receiving refunds when no taxes are paid. There are two large refundable tax credits which make this possible: the EITC (Earned Income Tax Credit) and the ACTC (Additional Child Tax Credit).

Debt and deficits being set aside for the time being, uncertainty caused by the passage of tax reform at the end of 2017 should no longer be an issue. It is clear that most people are better off. So about that trade war.

How To Win A Trade War

(Hint: Don’t Fight It)

This section title is copied directly from a recent article in Politico by Zachary Karabell, head of global strategy at Envestnet, a publicly traded financial technology company. In the article he makes a convincing argument that a trade war with China is both a bad idea and at the same time not a big deal, since China’s tariff response amounts, “As a proportion of the nearly $19 trillion U.S. economy…to less than 0.0003 percent.” So if the dollars and cents don’t make any sense we have to look for other reasons why posturing for a trade war would be a strategic move[i]

President Teddy Roosevelt is widely quoted for saying “speak softly and carry a big stick.” President Trump does not speak softly, however, he does want us to believe he is holding a big stick. Our interpretation of Trump is that he prefers bi-lateral (two-country) discussions to multi-lateral (more than two countries and organizations). It is easier to see the issues at hand and where an advantage can be pressed when there are fewer players at the table.

As for why the President would want to push China there are several reasons which have been discussed and one we will focus on. China has weak to non-existent intellectual property rights. In a particularly egregious case of industrial espionage, seven Chinese nationals were accused in 2013 of driving from farm to farm in the Midwest, digging up newly planted genetically modified seeds, and sending them back to China for analysis and copying. From seed theft to knock-off products to requiring companies wanting to do business in China to turn over their intellectual property, there are legitimate reasons to argue for some sort of action against these practices. It is estimated that Chinese theft of American IP currently costs between $225 billion and $600 billion annually. [ii]

If there are legitimate reasons to fight back against China and if the Chinese response to tariffs is so trivial, why would the President not have support? We think President Teddy hits the nail on the head with another excerpt from his famous big stick speech; “If a man continually blusters, if he lacks civility, a big stick will not save him from trouble, and neither will speaking softly avail, if back of the softness there does not lie strength, power.” President Trump blusters at every turn and civil is not an accurate assessment of his demeanor. His approach comes at a cost and that cost is trust. Trust speeds up the pace at which business can be done, likewise distrust can bring business to a screeching halt. The consensus from economists is that the risk to the US comes not from creating a global trade war but rather from a lack of trust from global trade partners if we continue to make it unclear how we are going to do business. No one likes playing a game where another player is constantly changing the rules. [iii]

San Diego Housing is Not Cheap

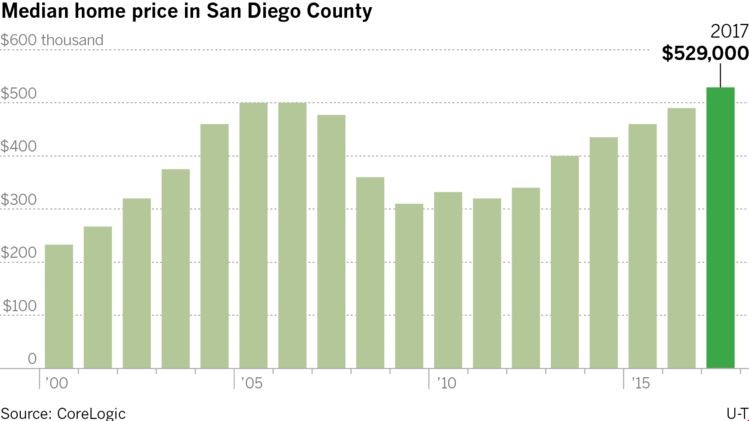

A major concern of clients has been the cost of housing and whether we have returned to a real estate bubble.

A recent article by the San Diego Union-Tribune addressed the price of housing in San Diego County and pointed out the fact we have now passed the peak of the mid-2000’s. This is likely an event which causes raw emotions because of the severity of the prior downturn and the fact we all know people who lost their homes in a short-sale or foreclosure. Good financial planning is more important than ever in the face of higher housing costs.[i]

It is impossible for us to say whether prices are going to keep rising, plateau or drop. However, we can abide by sound financial principles and make sure purchase versus rent decisions are made wisely. Buying a home prior to retirement to fix the costs of your housing is important. When you buy between now and then is a decision to be approached seriously and one we will guide you through.

Step 1. Rent-versus-Own analysis.

Step 2. Cash flow analysis.

Step 3a. Draft and implement a savings strategy.

Step 3b. Review credit and projected debt-to-income ratio and optimize.

Step 4. Execution and accountability.

We think it is quite possible that pressures which have caused other urban areas such as San Francisco to experience high housing costs, may be growing in San Diego. Housing is scarce, the tech industry is booming, and there is more culture and entertainment than ever. Prices may not come down much. If that is the case, planning is more important than ever.

The Federal Reserve

Federal Reserve interest rate policy is following the course which has been laid out over the last couple of years. Slow and steady interest rate increases and a slow unwinding of outstanding holdings to decrease the balance sheet. Fed. Chairman Jerome Powell, recently gave a speech titled, The Outlook for the U.S. Economy. His speech covered a lot of ground and was more lukewarm about the U.S. economy than anything else. Importantly he pointed out that, “after what at times has been a slow recovery from the financial crisis and the Great Recession, growth has picked up…The labor market has been strong, and my colleagues and I on the Federal Open Market Committee (FOMC) expect it to remain strong.”

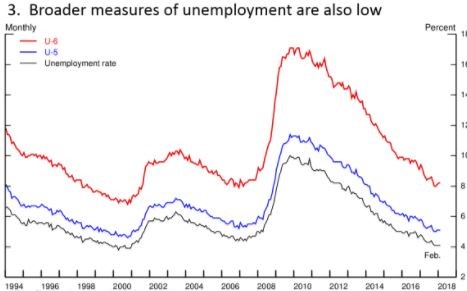

Note: Chart key shows curves in order from top to bottom

Source: U.S. Department of Labor, Bureau of Labor Statistics

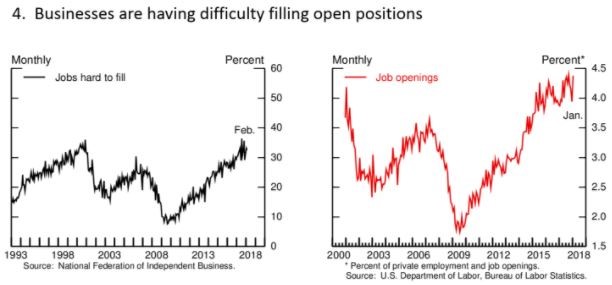

The lack of wage growth has been a frustration for quite a while. If the labor market remains strong as Chairman Powell and the FOMC hope, it may serve to drive wages higher. There are a couple of different metrics which can be looked at to help gauge the strength of labor markets. First is the broad measure of unemployment rates addressed above. Second we can look a bit more granular and see what employers are reporting regarding job offerings and ease of filling those openings.

It is a good time to be looking for a job. Employers are having a hard time filling positions while at the same time they are announcing more job openings. This should give workers some leverage over employers and assist the Federal Reserve in achieving their mandate of inflation stability and full employment[i]

Which brings us back to Chairman Powell, “As I mentioned, my FOMC colleagues and I believe that, as long as the economy continues broadly on its current path, further gradual increases in the federal funds rate will best promote these goals.” We should all expect to see continued interest rate increases on a quarterly basis for the time being, which will likely cause headwinds for fixed income investors similar to what we have been experiencing.

Looking Forward

- Following is the list of future concerns mentioned in our previous Economic Update along with a brief update:

- Indictment of President Trump.

– Still an issue hanging around.

- Impeachment of President Trump.

– The mid-term elections are shaping up to be quite interesting, the results of which will either squash or renew discussion of impeachment proceedings. For those interested in the most recent projections you can head to RealClearPolitics.com for updates on the Senate and House races.

- Failure of NAFTA negotiations to create a cohesive agreement.

– Still an issue hanging around.

- Italian elections on March 4th.

– Elections occurred and no clear ruling party emerged. Sigh of relief for now.

- North Korea nuclear ambitions.

– Some carryover love from the Olympics (and pressure from China) may be just what the world needed as the North Koreans are moving towards discussions in a rather surprising turnabout.

- Increase in Middle East instability.

– As most people are aware, the U.S. and our allies engaged in missile strikes on Syria in the past several days.

- Debt and Deficits

– Bigger and badder than ever at a projected $1.0 trillion estimated FY 2019 deficit. We are beginning to wonder if there is a parallel universe out there where the United States runs a budget surplus and actively invests in infrastructure.

There is still plenty of time for markets to turn around this year. That said, we are quite possibly in for a volatile ride as markets wait for political uncertainty to be shaken out in November. We are here to help you make rational, informed and well-reasoned decisions. We thank you for your continued trust and support. Your input is always welcome and we ask that you contact us with any questions or concerns.

DISCLOSURE

All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy. All economic and performance data is historical and not indicative of future results. Market indices discussed are unmanaged. Investors cannot invest in unmanaged indices. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards.

Investing in securities in emerging markets involves special risks due to specific factors such as increased volatility, currency fluctuations and differences in auditing and other financial standards. Securities in emerging markets are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments.

An index is a statistical measure of change in an economy or a securities market. In the case of financial markets, an index is an imaginary portfolio of securities representing a particular market or a portion of it. Each index has its own calculation methodology and is usually expressed in terms of a change from a base value. Thus, the percentage change is more important than the actual numeric value. An investment cannot be made directly into an index.

Investing in fixed income securities involves credit and interest rate risk. When interest rates rise, bond prices generally fall. Investing in commodities may involve greater volatility and is not suitable for all investors. Investing in a non-diversified fund that concentrates holdings into fewer securities or industries involves greater risk than investing in a more diversified fund. The equity securities of small companies may not be traded as often as equity securities of large companies so they may be difficult or impossible to sell. Neither diversification nor asset allocation assure a profit or protect against a loss in declining markets. Past performance is not an indicator of future results.

Securities offered through 1st Global Capital Corp., Member FINRA and SIPC. Steven W. Pollock, Sean P. Storck, Matthew J. Anderson and Nicole Albrecht are Registered Representatives of 1st Global Capital Corp. Investment advisory services, including RBFI portfolios offered through Reason Financial. IMS platform accounts offered through 1st Global Advisors, Inc. Reason Financial. and 1st Global Capital Corp. are unaffiliated entities. Reason Financial is a Registered Investment Adviser. Placing business through 1st Global Insurance Services. Registration does not imply a certain level of skill or training. We currently have individuals licensed to offer securities in the states of Arizona, California, Illinois, Indiana, Kansas, Massachusetts, Michigan, New York, Oregon and Washington. This is not an offer to sell securities in any other state or jurisdiction. CA Department of Insurance License: Steven W. Pollock #OE98073, Sean P. Storck #0F25995, Matthew J. Anderson #0F21959 and Nicole Albrecht #0F99962.

Copyright © 2018 Reason Financial all rights reserved.

Reason Financial

4747 Morena Blvd, Suite 102, San Diego, CA 92117

[i] Guide to the Markets – U.S. Data are as of March 31, 2018, J.P. Morgan Asset Management

[i] Saunders, Laura. “Top 20% of Americans Will Pay 87% of Income Tax.” The Wall Street Journal, Dow Jones & Company, 6 Apr. 2018, www.wsj.com/articles/top-20-of-americans-will-pay-87-of-income-tax-1523007001.

[i] Karabell, Zachary, et al. “How to Win a Trade War With China.” POLITICO Magazine, POLITICA Magazine, 7 Apr. 2018, www.politico.com/magazine/story/2018/04/07/how-to-win-trade-war-china-217830.

[ii] United States Trade Representative. “Findings Of The Investigation Into China’s Acts, Policies, and Practices Related to Technology Transfer, Intellectual Property and Innovation Under Section 301 Of The Trade Act of 1974.” Ustr.gov, 22 Mar. 2018, pp. 203–203., ustr.gov/sites/default/files/Section%20301%20FINAL.PDF.

[iii] Welter, Ben. “Sept. 3, 1901: Roosevelt ‘Big Stick’ Speech at State Fair.” Star Tribune, Star Tribune, 2 Sept. 2014, www.startribune.com/sept-3-1901-roosevelt-big-stick-speech-at-state-fair/273586721/.

[i] Molnar, Phillip, and Shaffer Grubb. “Last Year’s Housing Market Broke Records.”Sandiegouniontribune.com, 15 Feb. 2018, www.sandiegouniontribune.com/business/real-estate/sd-fi-2017-housing-recap-20180214-story.html.

[i] “Speech by Chairman Powell on the Outlook for the U.S. Economy.” Board of Governors of the Federal Reserve System, 6 Apr. 2018, www.federalreserve.gov/newsevents/speech/powell20180406a.htm.

[ii] Press, Associated. “The US Government’s Budget Deficit Is about to Explode – and the Trump Tax Law and Spending Surge Is to Blame.” Business Insider, Business Insider, 9 Apr. 2018, www.businessinsider.com/us-budget-deficit-1-trillion-2019-cbo-report-2018-4.