July 2015 – An Economic and Market Update

EXECUTIVE SUMMARY

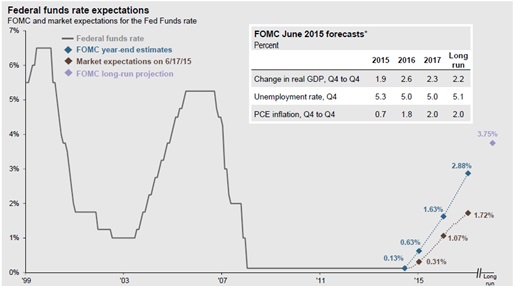

- Interest rates continue to be a focus of attention, particularly with the current divergence between market expectations and those of the Federal Open Market Committee (FOMC).

- A new word has been added to the lexicon with “Grexit” becoming the title of the Greek crisis. A final agreement appears to be coming to the floor after 6 long and tumultuous years.

- Puerto Rico is not to be outdone by Greece and has our attention as the impact to municipal bond markets could be substantial.

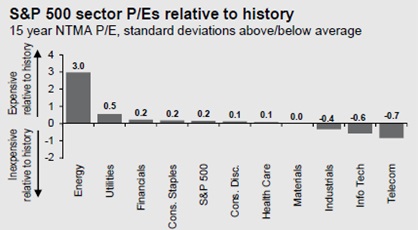

- Despite headlines, volatility and a 7 year bull-run, most sectors of the market appear in-line with historical price valuations with the exceptions being energy and utilities.

LOOKING BACK

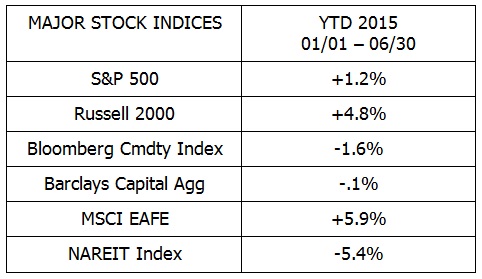

January 1, 2015 through June 30, 2015

Source: JP Morgan Asset Management

Current financial stresses shaking China and Greece have served to increase volatility in the last month; otherwise it has been a pretty uneventful year to date. After experiencing significant growth in 2013 and 2014 the markets are showing patience and resolve with half the primary indices measured above within 2% up or down on the year.

The market speculation surrounding interest rates continues to be a dominating headline. It is important to note there are significant differences between what the market anticipates of future interest rates versus the published Federal Open Market Committee (FOMC) expectations.

Source: FactSet, Federal Reserve, J.P. Morgan Asset Management

Market expectations are the federal funds rates priced into the fed futures market as of the date of the June 2015 FOMC meeting.

Guide to the Markets –U.S. Data are as of June 30, 2015

The graph provided above indicates Market expectations as to the size of increase to the Federal Funds rate are roughly half of FOMC expectations dependent upon the timeframe being measured. While both show an upward adjustment to rates by the end of 2015, the economic response to these higher interest rates will ultimately be the guiding light for the FOMC. We believe reality will fall somewhere within the range built into expectations.[i]

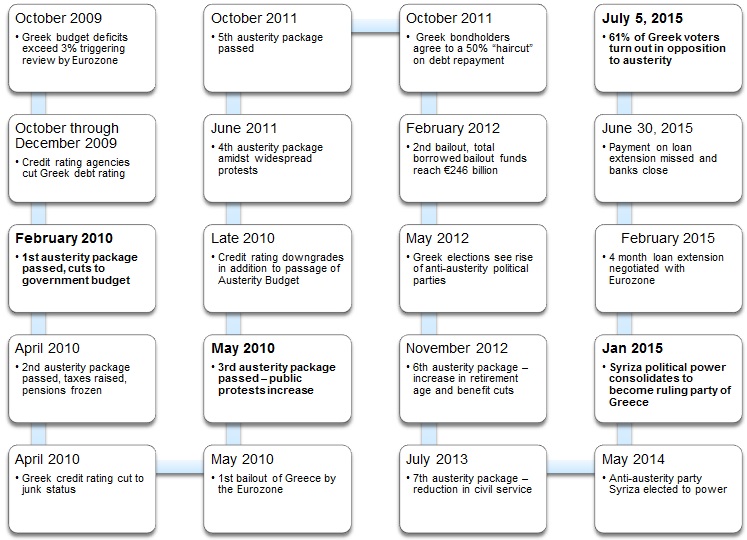

THE GREXIT

Much has been written, discussed, worried over, debated, voted on, etc. regarding the Greek debt situation. The current crisis entered World consciousness in October of 2009 at the depths of the financial crisis when Greek budget deficits reached 12.5% of its Gross Domestic Product (GDP) exceeding the 3% limit as set by Eurozone rules. With the current dialogue playing out in the headlines we believe it is valuable to review some of the major events of the last 6 years in Greek finance.[ii]

Timeline of Major Events

As we prepared our thoughts for print – We still lack resolution to the crisis as the Greek ruling party negotiates with the IMF, ECB, and other related parties to come up with a solution preventing a Greek exit from the Eurozone. News reports on Sunday indicate an agreement is near as long as a series of six (6) reforms are put in place by Wednesday the 15th of July.

For citizens of Greece this has been painful. Capital controls, high taxes, high unemployment, reduced services, cuts to pensioners and closed banks are just a few of the difficulties. For Greece’s lenders, primarily the IMF and Eurozone countries such as Germany, continuing to lend money without regard to default risk is akin to throwing good money after bad.

As of Monday, July 13, 2015 – It is being reported that over the July 11th weekend both sides worked tirelessly to reach an agreement. The focus now turns to the Greek Parliament and whether or not they accept the concessions made and will move forward to allow Greece its third bailout in five years.[iii]

Greece is a moving target with new and more current events developing daily. It is our hope that a resolution for Greece will be ratified this week.

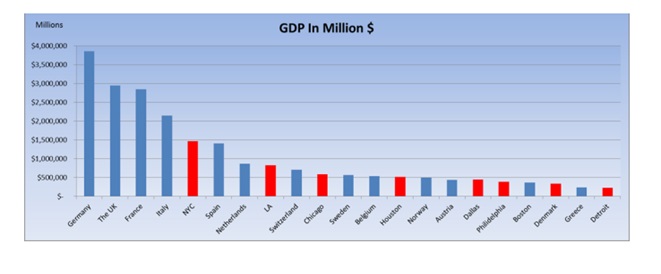

Source: City Data from BEA.Gov as of 2013; Country Data from Countryeconomy.com as of 2014

Source: City Data from BEA.Gov as of 2013; Country Data from Countryeconomy.com as of 2014

While defaults are painful, and the personal cost to those affected is high, our current predicament appears to be a case of how headlines can get a bit excited. Europe will certainly be more affected by a Greek default/debt-restructuring than the United States, but it is important to consider the size of the risk relative to the system as a whole. The graph above intersperses the size of various European Union countries to major metropolitan areas in the United States. With Greece and Detroit running neck and neck in economic production we expect some financial pain, but with the very public discourse taking place we do not expect the financial system to be taken by surprise. Not unlike the experience we have had with Detroit negotiating bankruptcy over the last 6 years.[iv]

PUERTO RICO

Puerto Rico has, for the most part, managed to avoid the spotlight as the media zeroed in on the Grexit. However, the ability of the US Protectorate to payback the $72 billion dollars of outstanding Puerto Rican municipal debt is in serious doubt. US investors ought to take note as a significant number of municipal bond funds in the United States hold Puerto Rican debt. This is a result of a unique tax benefit where holders of Puerto Rican municipal debt pay no tax at any level of taxation be it State or Federal.[v]

To put Puerto Rico in context with other countries in the world U.S. News recently reported, “that if Puerto Rico were considered a developing country, it would be the eighth most heavily indebted country in the world. If the island does not obtain the right to declare bankruptcy, it will either restructure the debt or go into default.”[vi]

This is something we have been concerned about for some time now as we saw certain municipal bond funds increasing exposure to the island’s debt in an attempt to increase yield in a low-yield environment. We took action to reduce exposure by removing Oppenheimer municipal funds from our fixed income strategy. This has not reduced our exposure to zero, but we believe it will help to mitigate losses in the event of a default or restructuring. We will continue to monitor the situation with Puerto Rico as it progresses.

LOOKING FORWARD

The markets have experienced increased volatility in recent weeks evidenced by significant sell-offs in the European and Chinese stock exchanges. It is important to note we are in our 7th year of investment gains since 2008. Markets appear to be fairly priced, particularly in light of current real interest rates. In fact, with the exception of the Energy and Utilities sectors most other facets of the market are in line with previous pricing history.[vii]

Source: CBOE, FactSet, Standard & Poor’s, J.P. Morgan Asset Management

Guide to the Markets –U.S. Data are as of June 30 2015

The above graph compares the next twelve month aggregate (NTMA) price to earnings (P/E) of the companies included in the S&P 500 stock index price as expensive or inexpensive relative to the sector’s historical P/E.

While measurements of pricing help us ascertain to some degree the level of risk in the markets, external events/risks are always present. Specifically, we believe the market narrative is going to quickly shift to the next major catalyst – that is, a US interest rate hike. The timing remains unknown but the overwhelming consensus is of an increase in the short term.

We remain committed to the protection of your assets and the growth of your investment portfolio. Our focus is to protect value, provide you with trusted advice, and assist you and your family in making good decisions over your lifetime.

We thank you for your continued trust and support. Your input is always welcome and we ask that you contact us with any questions or concerns.

DISCLOSURE

All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy. All economic and performance data is historical and not indicative of future results. Market indices discussed are unmanaged. Investors cannot invest in unmanaged indices. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards.

Investing in securities in emerging markets involves special risks due to specific factors such as increased volatility, currency fluctuations and differences in auditing and other financial standards. Securities in emerging markets are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments.

An index is a statistical measure of change in an economy or a securities market. In the case of financial markets, an index is an imaginary portfolio of securities representing a particular market or a portion of it. Each index has its own calculation methodology and is usually expressed in terms of a change from a base value. Thus, the percentage change is more important than the actual numeric value. An investment cannot be made directly into an index.

Investing in fixed income securities involves credit and interest rate risk. When interest rates rise, bond prices generally fall. Investing in commodities may involve greater volatility and is not suitable for all investors. Investing in a non-diversified fund that concentrates holdings into fewer securities or industries involves greater risk than investing in a more diversified fund. The equity securities of small companies may not be traded as often as equity securities of large companies so they may be difficult or impossible to sell. Neither diversification nor asset allocation assure a profit or protect against a loss in declining markets.

Past performance is not an indicator of future results.

Securities offered through 1st Global Capital Corp., Member FINRA and SIPC. Bruce Rawdin-Baron, Steven W. Pollock, Sean Storck and Nicole Albrecht are Registered Representatives of 1st Global Capital Corp. Investment advisory services, including RBFI portfolios offered through Rawdin-Baron Financial, Inc. IMS platform accounts offered through 1st Global Advisors, Inc. Rawdin-Baron Financial, Inc. and 1st Global Capital Corp. are unaffiliated entities. Rawdin-Baron Financial, Inc. is a Registered Investment Adviser. Placing business through 1st Global Insurance Services. Registration does not imply a certain level of skill or training. We currently have individuals licensed to offer securities in the states of Arizona, California, Illinois, Indiana, Kansas, Massachusetts, Michigan, New York, Oregon and Washington. This is not an offer to sell securities in any other state or jurisdiction. CA Department of Insurance License: Bruce Rawdin-Baron #0736631, Steven W. Pollock #OE98073, Sean Storck #0F25995 and Nicole Albrecht #0F99962.

Copyright © 2015 Rawdin-Baron Financial Inc., all rights reserved.

Rawdin-Baron Financial, Inc., 4747 Morena Blvd, Ste 102, San Diego, CA 92117