July 2017 – An Economic and Market Update

AN ECONOMIC AND MARKET UPDATE

Quarterly Market Update – July 2017

![]()

- The French voted and the Eurozone survived. Euroscepticism rose and fell and it appears the EU will be stronger for it as France and Germany strengthen their political bonds.

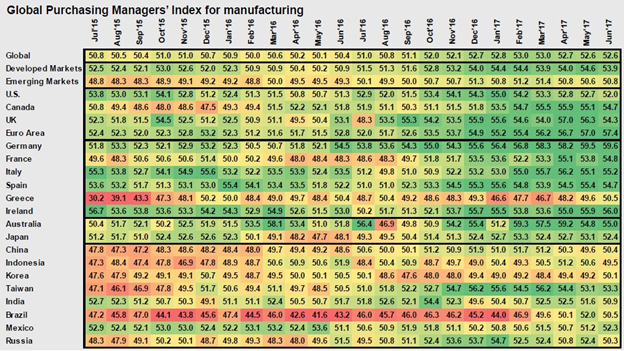

- The Purchasing Managers Index indicates improved economic conditions in many of the countries across the globe.

- The Federal Reserve had a lot to say in their last meeting in June. We take some time to discuss their generally positive tone on the U.S. and Global Economies.

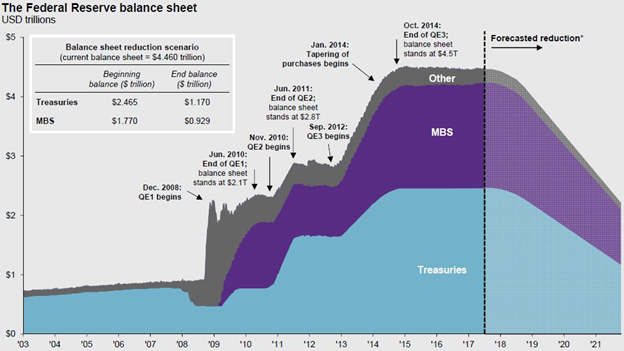

- Monetary policy is returning to normal, although it is going to take a while to unwind the significant balance sheet positions of the Federal Reserve.

LOOKING BACK

Our April 2017 – Economic and Market Update focused significantly on the French Presidential Election. The date of the election has come and gone and the statisticians got this one right. Emmanuel Macron is the new President of France in an election which saw him take an estimated 65% of the vote. The election of President Macron is a stabilizing event for the Eurozone in general and brings France and Germany closer together. The Financial Times noted this alignment with an enthusiastic comment in June stating, “The upshot: a reinvigorated German-Franco axis that could spawn more political cohesion and economic integration, including a Eurozone budget, Eurozone bonds and greater regulatory standardisation (sic) across many fragmented markets.”[i] It may feel a little anticlimactic now that the vote is over and the EU appears to be on stable ground, but it really was a concerning possibility that the European Union could break up.

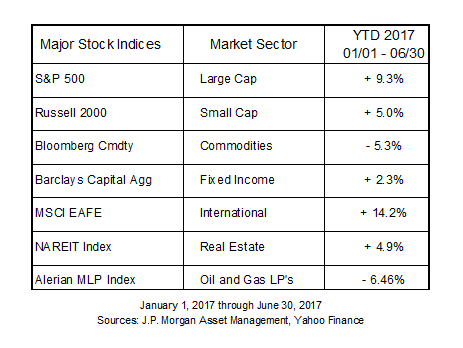

The markets continued a general march upward except for the broad basket of commodities represented in the Bloomberg Commodity Index. International markets are leading the way at this time while U.S. stocks post more moderate gains. There is a significant disparity between the types of stocks performing well to this point in the year.

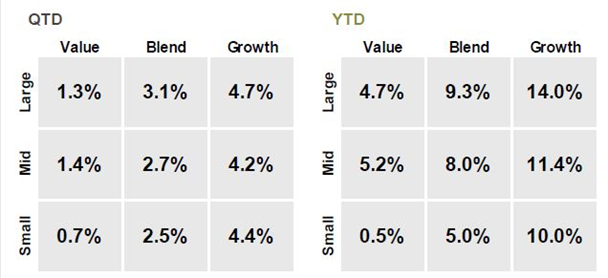

Source: FactSet, J.P. Morgan Asset Management, Guide to the Markets – U.S. Data are as of June 30, 2017, Page 8

The chart above is called a stylebox and illustrates market returns over various market cap sizes and company profiles. Market cap is indicated by either a Small, Mid, or Large tag. Company profile is represented by either Value, Blend, or Growth. Growth stocks are significantly outperforming Value stocks to this point in 2017. This is the exact reverse of circumstances in 2016 when Value dramatically outperformed Growth. Portfolios under $250k are going to experience this more acutely than those over $250k where economies of scale dictate fewer holdings. Importantly it is a reminder of the fickle nature of markets and how the momentum play of last year will not necessarily be the same play next year.

THE FEDERAL RESERVE and ECONOMICS

The most recent meeting of the Federal Reserve Board on June 13-14, 2017 was a wealth of information for those willing to wade through the meeting minutes and accompanying slides. What follows is an examination of a variety of statements made during the meeting and what they potentially mean for the United States and further abroad.

We ended the April 2017 – Economic and Market Update with a quote from the Federal Reserve stating that, “Near-term risks to the economic outlook appear roughly balanced.” This statement was reiterated at the most recent meeting with the addition of “continued to see”.[ii]

Source: Markit, J.P. Morgan Asset Management. Heatmap colors are based on PMI relative to the 50 level, which indicates acceleration or deceleration of the sector, for the time period shown. Guide to the Markets – U.S. Data are as of June 30, 2017

The heatmap above measures the Purchasing Managers Index (PMI). Readings above 50 are viewed as representing an expansionary economic environment and vice versa for readings below 50. The Fed validated the generally positive PMI measurements in their last meeting. “The economic expansions in Canada and the euro area (sic) as well as in China and many other emerging market economies (EMEs) continued to firm in the first quarter.” The lone country specifically mentioned as lagging is the United Kingdom. This is most likely due to the confusion surrounding the disengagement of the UK from the Eurozone and lost economic growth as the path out continues to be negotiated.[iii]

Room for optimism exists in the global economy. We believe diverse portfolios will benefit from allocations to International Developed and Emerging Market equities as the global recovery picks up speed.

Additionally, the Federal Reserve provided a significant amount of positive sentiment concerning the U.S. on a variety of fronts (all quotes are from the June 13-14, 2017 Fed Meeting):

Regarding Industrial Production

“Total industrial production rose considerably in April, reflecting gains in manufacturing, mining, and utilities output.”[iv]

Regarding Consumer Sentiment

“Moreover, consumer sentiment, as measured by the University Of Michigan Surveys Of Consumers, remained upbeat in May.”[v]

Regarding Private Expenditures for Business

“Real private expenditures for business equipment and intellectual property seemed to be increasing further after rising at a solid pace in the first quarter…In addition, indicators of business sentiment were upbeat in recent months.”[vi]

Even the bad news was tempered.

Regarding rising delinquencies in Commercial Mortgage-Backed Securities (CMBS):

“The increase in those delinquencies had generally been expected by market participants and was not anticipated to have a material effect on credit availability or market conditions.”[vii]

On Labor Markets and Economic Activity

“In their discussion of the economic situation and the outlook, meeting participants agreed that the information received over the intermeeting period indicated that the labor market had continued to strengthen and that economic activity had been rising moderately, on average, so far this year.”[viii]

Positive statements aside, there has been no change to the very basic fact that stocks are expensive in comparison to historic norms.[ix] Now is a time for tempered enthusiasm not irrational exuberance.

WHAT HAPPENS TO THAT INFAMOUS BALANCE SHEET

Source: Federal Reserve, FactSert, J.P. Morgan Asset Management. Guide to the Markets – U.S. Data are as of June 30, 2017

An oft-cited potential economic bogeyman is the unwinding of the Federal Reserve Balance Sheet. During the most recent financial crisis the Federal Reserve dramatically increased their balance sheet, effectively “printing money” in order to provide financial liquidity. It is easy to find the opinion of those who believe this huge distortion to the monetary system will trigger an eventual meltdown. Make no mistake that we are in uncharted territory here. However, the fact that the unwinding is beginning is a good sign. “The Committee expected to begin implementing a balance sheet normalization program in 2017, provided that the economy evolves broadly as anticipated.”[x]

The beginning of the unwinding represents a return to normalcy. The Federal Reserve has left themselves the option to pause the process at any time if it appears that economic circumstances retreat. This is an experiment and one we all have to live with.

THE INTERSECTION OF POLICY, PROJECTION and LOOKING FORWARD

We can always find reasons to be worried; investors and parents have something in common in that regard. Right now an item of concern is the effectiveness of government policy. The Governors of the Federal Reserve have an answer for this as well:

“In their discussion of the uncertainty attached to their current projections, most participants again expressed the view that, at this point, uncertainty surrounding prospective changes in fiscal and other government policies is very large or that there is not yet enough information to make reasonable assumptions about the timing, nature, and magnitude of the changes.”[xi]

This means we just don’t know what impact government fiscal policy will have on the economy. In time we will find out, but for now we do not have clarity. We are looking forward to the current debate on healthcare being resolved so that infrastructure development/improvement and tax reform can take center stage. In the meantime, we are pleased with the level of economic improvement seen globally and hope it will continue advancing.

We are here to help you make rational, informed and well-reasoned decisions in spite of the challenges ahead. We thank you for your continued trust and support. Your input is always welcome and we ask that you contact us with any questions or concerns.

DISCLOSURE

All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy. All economic and performance data is historical and not indicative of future results. Market indices discussed are unmanaged. Investors cannot invest in unmanaged indices. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards.

Investing in securities in emerging markets involves special risks due to specific factors such as increased volatility, currency fluctuations and differences in auditing and other financial standards. Securities in emerging markets are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments.

An index is a statistical measure of change in an economy or a securities market. In the case of financial markets, an index is an imaginary portfolio of securities representing a particular market or a portion of it. Each index has its own calculation methodology and is usually expressed in terms of a change from a base value. Thus, the percentage change is more important than the actual numeric value. An investment cannot be made directly into an index.

Investing in fixed income securities involves credit and interest rate risk. When interest rates rise, bond prices generally fall. Investing in commodities may involve greater volatility and is not suitable for all investors. Investing in a non-diversified fund that concentrates holdings into fewer securities or industries involves greater risk than investing in a more diversified fund. The equity securities of small companies may not be traded as often as equity securities of large companies so they may be difficult or impossible to sell. Neither diversification nor asset allocation assure a profit or protect against a loss in declining markets. Past performance is not an indicator of future results.

Securities offered through 1st Global Capital Corp., Member FINRA and SIPC. Bruce Rawdin-Baron, Steven W. Pollock, Sean P. Storck, Matthew J. Anderson and Nicole Albrecht are Registered Representatives of 1st Global Capital Corp. Investment advisory services, including RBFI portfolios offered through Reason Financial. IMS platform accounts offered through 1st Global Advisors, Inc. Reason Financial. and 1st Global Capital Corp. are unaffiliated entities. Reason Financial is a Registered Investment Adviser. Placing business through 1st Global Insurance Services. Registration does not imply a certain level of skill or training. We currently have individuals licensed to offer securities in the states of Arizona, California, Illinois, Indiana, Kansas, Massachusetts, Michigan, New York, Oregon and Washington. This is not an offer to sell securities in any other state or jurisdiction. CA Department of Insurance License: Bruce Rawdin-Baron #0736631, Steven W. Pollock #OE98073, Sean P. Storck #0F25995, Matthew J. Anderson #0F21959 and Nicole Albrecht #0F99962.

Copyright © 2017 Reason Financial all rights reserved.

Reason Financial

4747 Morena Blvd, Suite 102, San Diego, CA 92117

ENDNOTES

[i] Quinlan, Joseph. “Merkel-Macron Axis To Prove Pivotal For Global Investors.” Financial Times. www.ft.com. 12 June 2017.

[ii] Federal Reserve Board. “Minutes of the Meeting of June 13-14, 2017.” www.Federalreserve.gov. https://www.federalreserve.gov/monetarypolicy/files/fomcminutes20170614.pdf

[iii] Federal Reserve Board. “Minutes of the Meeting of June 13-14, 2017.” www.Federalreserve.gov. https://www.federalreserve.gov/monetarypolicy/files/fomcminutes20170614.pdf

[iv] Federal Reserve Board. “Minutes of the Meeting of June 13-14, 2017.” www.Federalreserve.gov. https://www.federalreserve.gov/monetarypolicy/files/fomcminutes20170614.pdf

[v] Federal Reserve Board. “Minutes of the Meeting of June 13-14, 2017.” www.Federalreserve.gov. https://www.federalreserve.gov/monetarypolicy/files/fomcminutes20170614.pdf

[vi] Federal Reserve Board. “Minutes of the Meeting of June 13-14, 2017.” www.Federalreserve.gov. https://www.federalreserve.gov/monetarypolicy/files/fomcminutes20170614.pdf

[vii] Federal Reserve Board. “Minutes of the Meeting of June 13-14, 2017.” www.Federalreserve.gov. https://www.federalreserve.gov/monetarypolicy/files/fomcminutes20170614.pdf

[viii] Federal Reserve Board. “Minutes of the Meeting of June 13-14, 2017.” www.Federalreserve.gov. https://www.federalreserve.gov/monetarypolicy/files/fomcminutes20170614.pdf

[ix] J.P. Morgan Guide to the Markets. J.P. Morgan Asset Management. 30 June 2017. https://am.jpmorgan.com/blob-gim/1383407651970/83456/MI-GTM_3Q17_Linked_2.pdf?segment=AMERICAS_US_ADV&locale=en_US

[x] Federal Reserve Board. “Minutes of the Meeting of June 13-14, 2017.” www.Federalreserve.gov. https://www.federalreserve.gov/monetarypolicy/files/fomcminutes20170614.pdf

[xi] Federal Reserve Board. “Minutes of the Meeting of June 13-14, 2017.” www.Federalreserve.gov. https://www.federalreserve.gov/monetarypolicy/files/fomcminutes20170614.pdf