October 2014 – An Economic and Market Update

EXECUTIVE SUMMARY

• Recent manufacturing data from the Institute of Supply Management (ISM®) indicates the economy is growing.

• The Federal Reserve brought an end to Quantitative Easing, while also indicating interest rates will remain low until economic data convinces them to do otherwise. (i)

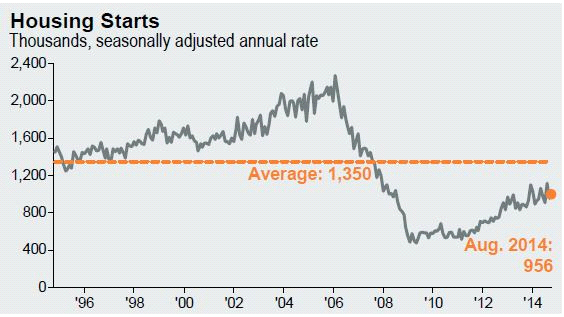

• Current data show that housing starts are on an upward trend but remain below historic averages. (ii)

• For the first time in 40 years PIMCO is without its founder. Bill Gross resigned from PIMCO and announced joining with Janus Investment Group.

LOOKING BACK: MAJOR STOCK INDICES

MAJOR STOCK INDICES YTD (2014, 01/01 – 09/30)

S&P 500 +6.70%

Russell 2000 -2.14%

DJ UBS Cmdty -7.16%

Barclays Bond Agg +2.45%

MSCI EAFA -2.72%

NAREIT Index +11.37%

(January 1, 2014 to September 30, 2014)

Source: Morningstar®

YTD 2014 01/01 – 09/30 S&P 500 +6.70% Russell 2000 -2.14% DJ UBS Cmdty -7.16% Barclays Bond Agg +2.45% MSCI EAFA -2.72% NAREIT Index +11.37% January 1, 2014 to September 30, 2014 Source: Morningstar® The Third Quarter came to an end with the Dow Jones Industrial Average at 17042.90.

The current bull market, March of 2009 to Present, has seen the DOW spend a majority of its time at or near record highs with very little in the way of a correction. The decline in stock prices over the last two weeks along with the increase in market volatility as measured by the VIX Index, leads us to believe that a market correction may be occurring. A market correction is defined as a 10% or greater drop in the broad stock market index. (iii)

MANUFACTURING DATA

A bright spot in the global economy has been the resurgence of the United States as a manufacturing stronghold. The Institute for Supply Management recently released updated figures on production and the numbers, while not as strong for September as for August, are healthy. (i)

Census Bureau, FactSet, J.P.Morgan Asset Management Data Data are as of 09/30/14

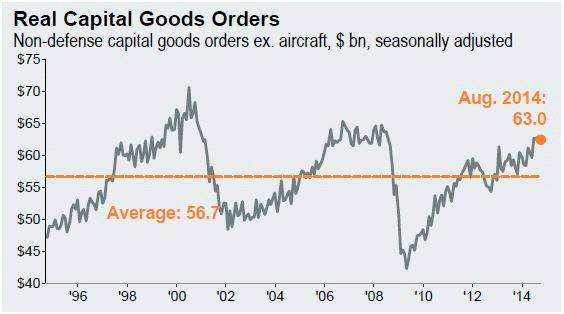

Real Capital Goods Orders, as reflected above, continue to move upward. Real Capital Goods are defined as man-made, durable items used by businesses in production and represent a direction for the economy. The Federal Reserve Board suggest that any measurement of the IMS® Production Index above 51.1 units reflects a growing economy and indicates that businesses are re-investing as they prepare for growth and increased productivity. The most recent ISM® Production Index reflected this sentiment as September saw a slight increase of .1 to 64.6 units. (iv,v)

Commerce Dept. Via the Federal Reserve Bank of St. Louis, Wall St. Journal

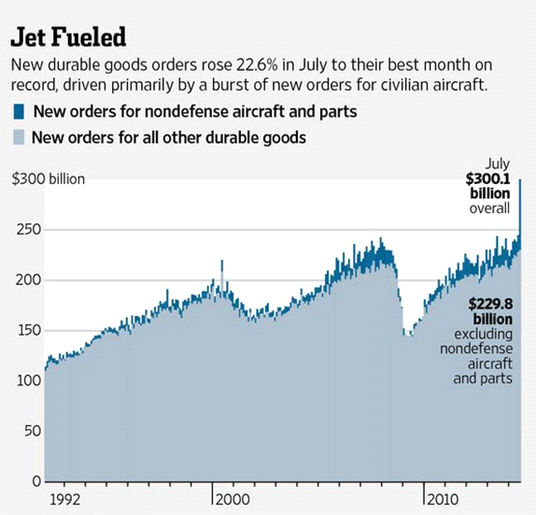

It is important to point out that the September additions to the ISM® Production Index reflect a slight decrease of momentum from the July and August numbers. In July, the manufacturing and production was primarily driven by a large increase in reported orders for aircraft. In fact, the 3rd quarter of 2014 saw the largest increase and highest level in new-orders since 1992. While these numbers only provide circumstantial evidence of an economy on the mend, when coupled with 6 straight months of 200k+ jobs added, an event which has not occurred in 17 years, the tide may finally turn regarding the persistent pessimism on the recovery. (vi)

THE FED STAYS THE COURSE

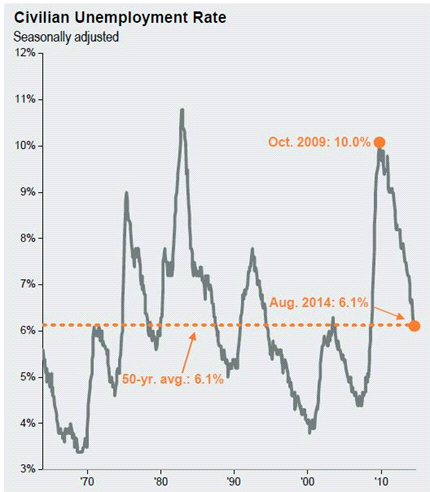

Janet Yellen and the Federal Open Market Committee (FOMC) have ended Quantitative Easing. The Federal Reserve has reiterated they do not intend to increase interest rates at this time. They remain committed to a rate increase at such a time as data indicates the economy is in a healthy recovery. Some direction can be gathered from the FOMC’s official Statement released on January 28, 2014, titled Longer-Run Goals and Monetary Policy Strategy. Employment data is a key figure directing monetary policy, and “in the most recent projections, FOMC participants’ estimates of the longer-run normal rate of unemployment had a central tendency of 5.2 percent to 5.8 percent.” (vii)

Source: BLS, FactSet, J.P. Morgan Asset Management Data are as of 09/30/14

As unemployment moves from the current rate of 6.1% into the Fed Target Range of 5.2 to 5.8% we can expect the Fed to begin raising rates.

REAL ESTATE AND HOUSING STARTS

As the following graph indicates the recovery in housing markets has improved consistently, yet has not reached the levels we would expect in a true recovery. Housing starts in August fell to an annualized rate of 956,000 compared to an average rate over the last 20 years of 1,350,000.

Census Bureau FactSet, J.P Morgan Asset Management

One factor that may be impeding recovery in housing are the new and relatively difficult lending standards required for approval of a mortgage loan. At the turn of the new millennium the average credit score as measured by FICO for a new loan was 660. Today the average is 743. While just a piece of the puzzle, the higher credit standards limit the number of potential buyers and the growth of this key component of the US economy. (viii)

GLOBAL ISSUES AND FINANCIAL WAVES

Global difficulties continue to dominate the headlines. Argentina, which defaulted on its debt in July, found itself in contempt of U.S. Court for failure to abide by court ordered payment schedules. ISIS remains front and center due to continued atrocities in the Middle East despite airstrikes by a U.S.-led coalition. Russia, in a bid to skirt Western economic sanctions, has turned to China for economic aid. There is much occurring, as there always is, and with the recent Ebola cases occurring in Dallas, it seems to hit much closer to home than normal. (ix,x)

Some time back we became concerned regarding an unexpected decline in the performance of the PIMCO Total Return Bond Fund and removed it from our portfolios. Recently, it came to light that there was dissension amongst the managers of the fund. On September 26, 2014, Bill Gross, founder of PIMCO and one of the most celebrated bond investors in the world, left PIMCO for Janus. His departure resulted in turmoil in the bond market and immediate withdrawals of more than $10 billion from the Total Return Fund. While it did not affect our managed portfolios, it is an important reminder that key management personnel matter. (xi)

We remain committed to the protection of your assets and the growth of your investment portfolio. Our focus is to protect value, provide you with trusted advice, and assist you and your family in making good decisions. Thank you for your continued trust and support. Your input is always welcome and we ask that you contact us with any questions or concerns.

DISCLOSURE All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy. All economic and performance data is historical and not indicative of future results. Market indices discussed are unmanaged. Investors cannot invest in unmanaged indices. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. Investing in securities in emerging markets involves special risks due to specific factors such as increased volatility, currency fluctuations and differences in auditing and other financial standards. Securities in emerging markets are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. An index is a statistical measure of change in an economy or a securities market. In the case of financial markets, an index is an imaginary portfolio of securities representing a particular market or a portion of it. Each index has its own calculation methodology and is usually expressed in terms of a change from a base value. Thus, the percentage change is more important than the actual numeric value. An investment cannot be made directly into an index. Investing in fixed income securities involves credit and interest rate risk. When interest rates rise, bond prices generally fall. Investing in commodities may involve greater volatility and is not suitable for all investors. Investing in a non-diversified fund that concentrates holdings into fewer securities or industries involves greater risk than investing in a more diversified fund. The equity securities of small companies may not be traded as often as equity securities of large companies so they may be difficult or impossible to sell. Diversification nor asset allocation assure a profit or protect against a loss in declining markets. Past performance is not an indicator of future results. Securities offered through 1st Global Capital Corp., Member FINRA and SIPC. Bruce Rawdin-Baron, Steven W. Pollock, Sean Storck and Nicole Albrecht are Registered Representatives of 1st Global Capital Corp. Investment advisory services, including RBFI portfolios offered through Rawdin-Baron Financial, Inc. IMS platform accounts offered through 1st Global Advisors, Inc. Rawdin-Baron Financial, Inc. and 1st Global Capital Corp. are unaffiliated entities. Rawdin-Baron Financial, Inc. is a Registered Investment Adviser. Placing business through 1st Global Insurance Services. Registration does not imply a certain level of skill or training. We currently have individuals licensed to offer securities in the states of Arizona, California, Illinois, Indiana, Kansas, Massachusetts, Michigan, New York, Oregon and Washington. This is not an offer to sell securities in any other state or jurisdiction. CA Department of Insurance License: Bruce Rawdin-Baron #0736631, Steven W. Pollock #OE98073, Sean Storck #0F25995 and Nicole Albrecht #0F99962. Copyright © 2014 Rawdin-Baron Financial Inc., all rights reserved. Rawdin-Baron Financial, Inc., 4747 Morena Blvd, Ste 102, San Diego, CA 92117

i. Institute for Supply Management, ISM® Production Index September 2014

ii. CNBC.com, Fed Will End QE Next Month, ‘Considerable Time’ Remains, September 17, 2014

iii. Investopedia.com, Definition – market correction

iv. Institute for Supply Management, ISM® Production Index September 2014

V. Investopedia, Capital Goods

VI. J.P. Morgan Guide to the Markets, all data as of 09/30/2014

VII. Federal Reserve Board, Monetary Policy, Statement on Longer-Run Goals and Monetary Policy as amended effective January 28, 2014

VIII. J.P. Morgan Guide to the Markets, all data as of 09/30/2014

IX. The Guardian, US Judge Holds Argentina in Contempt after Second International Debt Default. September 29, 2014

X. Bloomberg.com, Putin Deals China Winning Hand as Sanctions Power Rival, October 13, 2014

XI. Morningstar.com and The Washington Post, Morningstar Downgrades Pimco Return Citing Outflows, September 29, 2014