October 2015 – An Economic and Market Update

EXECUTIVE SUMMARY

- Two forces are significantly impacting global markets. The lack of Security and the element of Surprise are increasing volatility as evidenced by the significant price swings of the last couple months.

- A global slowdown is in process as evidenced in the most recent measurements of the Global Purchasing Managers Index. With growth cooling in most countries, time will tell if this is the beginning of a global recession or merely a breath in the middle of a long run.[i]

- Consumer Sentiment has seen a precipitous drop amidst a backdrop of uncertainty and mounting mass layoffs.

LOOKING BACK

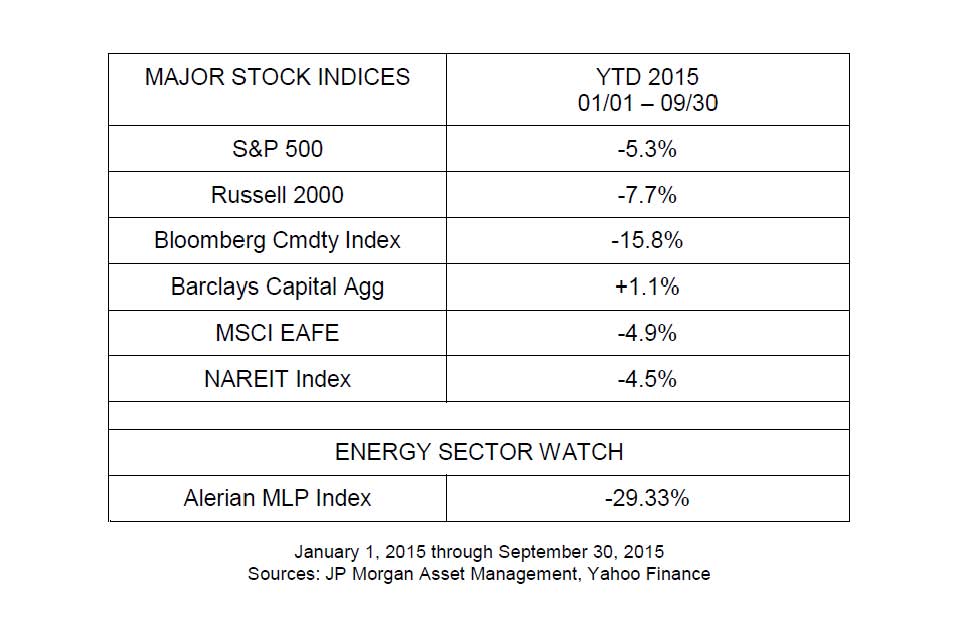

Returns in most asset classes have turned significantly downward over the last quarter led by the continuing fall of the energy sector. Commodity markets have been impacted most significantly as they hold the direct exposure to the raw materials (e.g. oil, iron, copper, aluminum, etc.) that can be bought or sold. The slowdown of the Chinese economy in particular has placed downward pressure on commodity prices and demand.

Returns in most asset classes have turned significantly downward over the last quarter led by the continuing fall of the energy sector. Commodity markets have been impacted most significantly as they hold the direct exposure to the raw materials (e.g. oil, iron, copper, aluminum, etc.) that can be bought or sold. The slowdown of the Chinese economy in particular has placed downward pressure on commodity prices and demand.

We believe it is valuable to include the Alerian MLP Index among the Major Stock Indices to provide a numerical representation of the impact lower costs of oil and gas have had on the energy sector in general. The energy renaissance experienced in the United States in the last several years has been an enormous boon to the economy. We are currently experiencing a hiccup as evidenced by the steep decline in value of Oil and Natural Gas distribution companies tracked by the Alerian MLP Index. This is a double-edged sword as consumers are benefiting from lower prices at the pump but those dependent upon the industry for their livelihood are feeling a slowdown at their job.

SECURITY AND SURPRISE

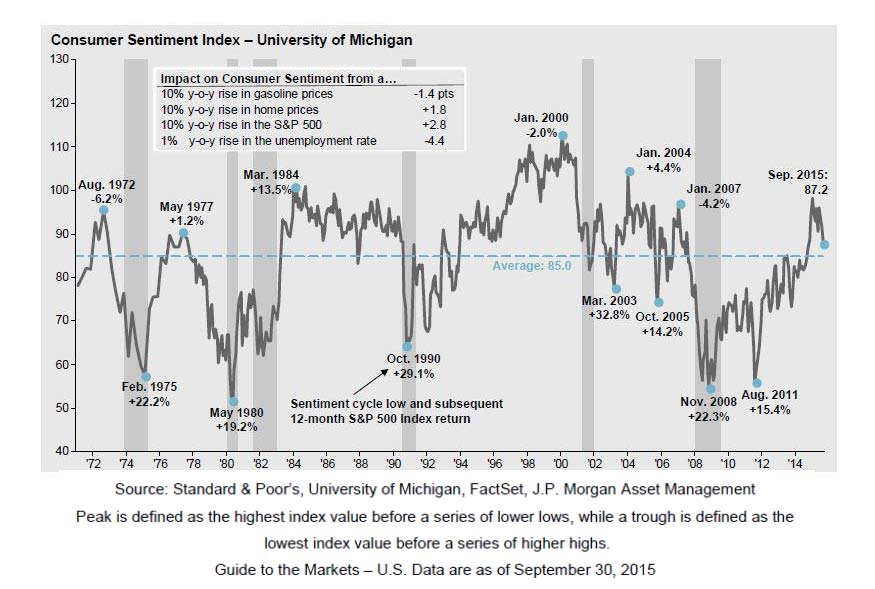

The recent market volatility can be defined by two related concepts: Security and Surprise. The idea of Security is important as investors across the globe search for secure footing and find sand rather than solid foundation. The element of Surprise is most impactful when Security is being tested and our ability to plan for the unknown is hindered. Geo-political events and economic data are, at present, colluding to prevent market participants from finding the solid ground on which to justify a continuance of the bull market, now in its 80th month, and on record as the second longest expansionary market ever. Consumers are signaling their decreasing faith in our present circumstances in the decline of the Consumer Sentiment Index as illustrated below.[ii]

Consumer Sentiment measurements are overlaid on the shaded areas representing an economic recession in the United States. Significant decreases in Consumer Sentiment often pre-date the occurrence of a recession, however, the volatility of this measurement is important to take into consideration. A recession is not a pre-determined outcome simply because the general public experiences average or negative sentiment directed at the economy. In fact, sentiment measurements have been well below average for much of the current bull market.

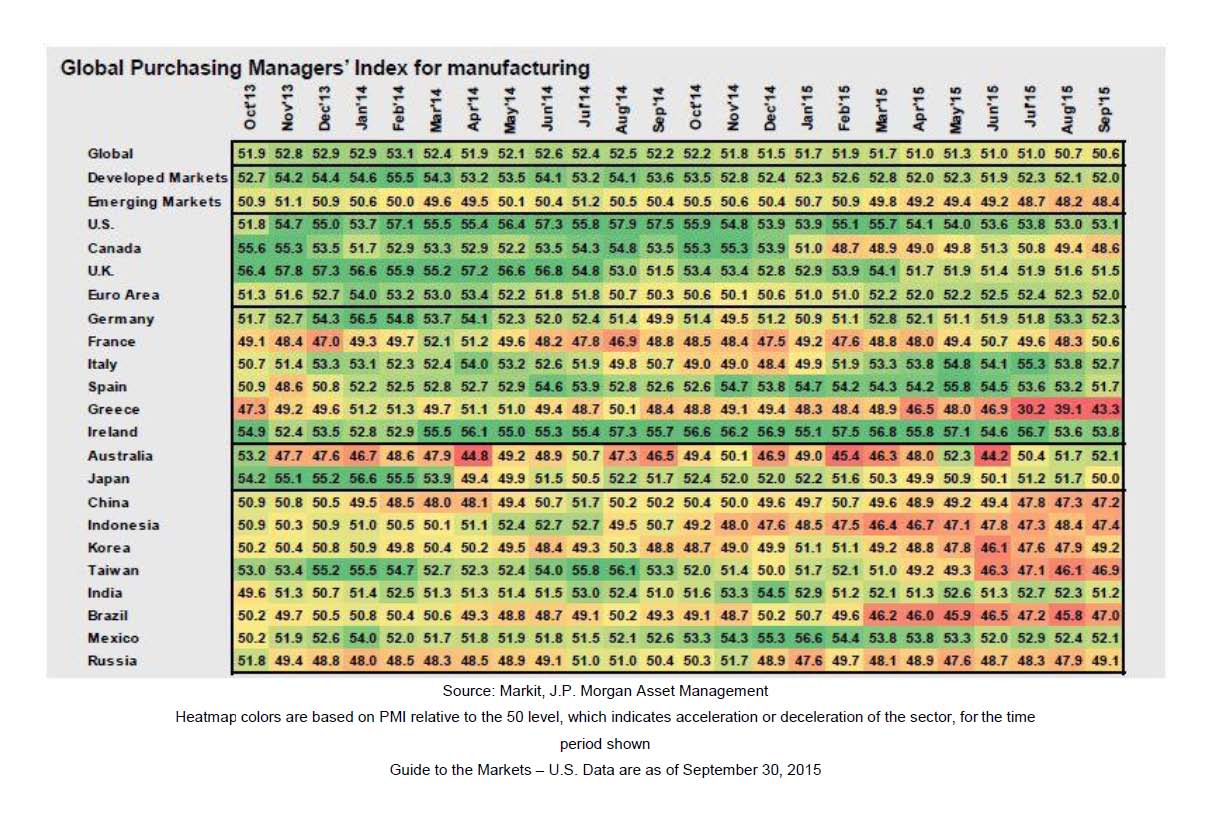

The Global Purchasing Managers’ Index for manufacturing provided below sheds light on the health of the world economies. It is one of our favorite economic graphs and data points. The Global Purchasing Managers Index is seeing a shift from expansion to slower expansion and in some cases contraction of the countries tracked.

The darker the green the stronger the expansion as represented by measurements over 50. Readings under 50 are represented by warmer colors with the more contractionary economic environments being represented by near reds. With few exceptions the economies of the world are slowing down. Despite global concerns the U.S. remains one of the strongest global economies as it attempts to navigate out of the fog, unsure of what might be ahead.

The darker the green the stronger the expansion as represented by measurements over 50. Readings under 50 are represented by warmer colors with the more contractionary economic environments being represented by near reds. With few exceptions the economies of the world are slowing down. Despite global concerns the U.S. remains one of the strongest global economies as it attempts to navigate out of the fog, unsure of what might be ahead.

A FAREWELL TO BOEHNER

Speaker of the House John Boehner recently surprised everyone by resigning from his position as leader of the House of Representatives. Viewed strictly as an isolated occurrence this does not seem like a dramatic event, especially considering his challenged tenure dealing with attacks from within his own party and the opposition. Protocols in place for the replacement of elected officials, as well as for the position of Speaker, make it a matter of process to search for a replacement. However, we need to look a little deeper at two of the most contentious issues during Speaker Boehner’s tenure to understand the true impact his resignation will have: passing a budget and raising the debt ceiling.[iii]

Here is something we have not heard before; the United States is on a collision course with default (sarcasm intended). We face this as a nation for the second time in as many years, indicated by Treasury Sec. Jacob J. Law who on October 2nd warned the, “government will default in early November unless Congress raises[sic] debt ceiling, weeks earlier than had been expected”. The day prior to the Treasury Secretary’s comments Congress passed an emergency budget allowing for the government to be funded through December in anticipation of an approved comprehensive budget prior to Boehner finishing out the term of his resignation. The surprise of Speaker Boehner’s resignation has given hope to some that security may arise in the form of a budget deal and debt ceiling negotiation. The cost of another government shutdown could be even more significant than the last one.[iv]

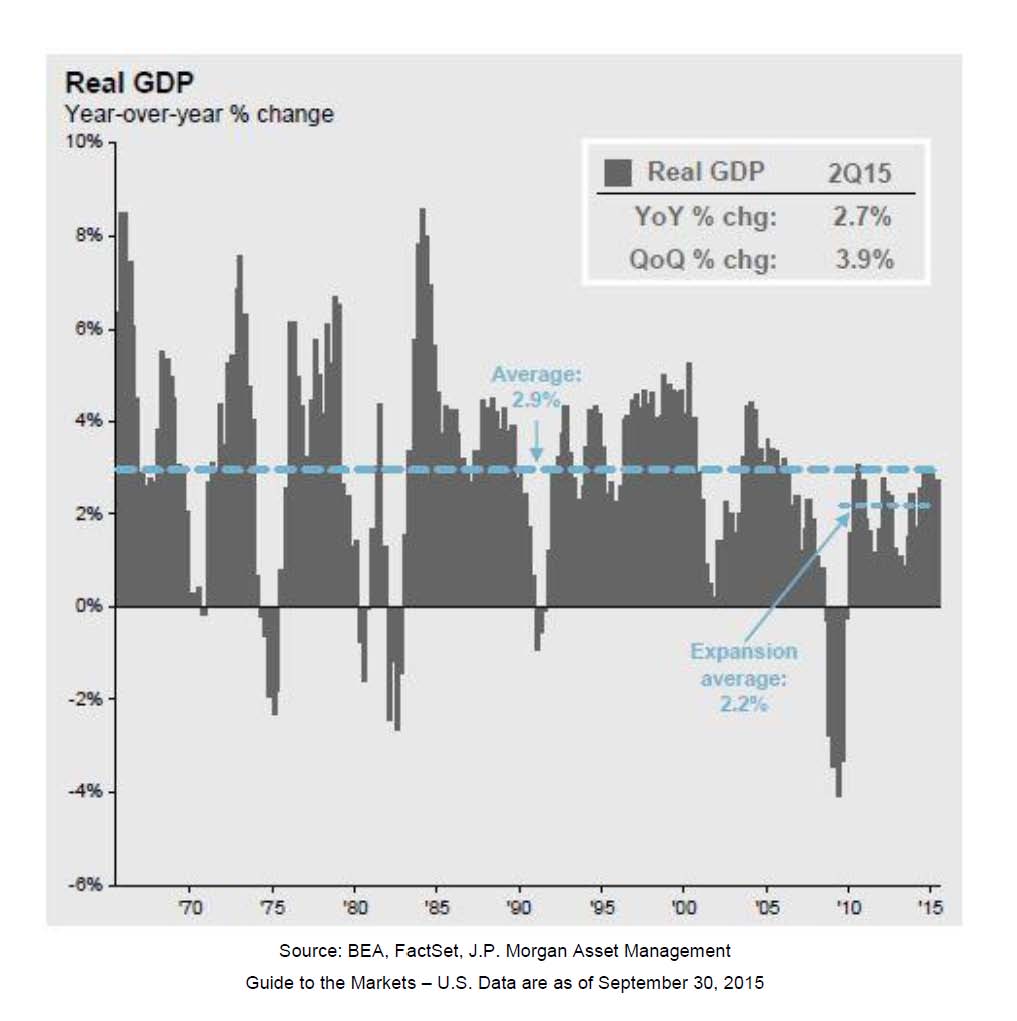

In 2013, when Congress failed to pass a budget it was estimated the closure of the

government cost the United States up to .6% of GDP growth in the quarter impacted by the closure, a significant number when compared against average GDP growth in this expansion of 2.2% as seen in the above illustration. Failure to pass a budget or raise the debt ceiling as necessary will exacerbate the current lack of security felt by the markets and significantly impact the tepid growth rates we have been experiencing during this expansionary period; not an attractive scenario and one we think is unlikely.[v]

A SURPRISE FROM VOLKSWAGEN

Front page news of Volkswagen’s deception and trickery are center stage as the depth of their flagrant violation of US air quality laws and lying to authorities and customers has been made public. The shock and surprise of this deception is an example of how one event can bring an incredible amount of uncertainty to a region, industry, country or even the global economy. This is not a tempest in a teapot. VW employs 270,000 workers in Germany directly, is the largest automaker in the world, indirectly impacts the livelihood of countless vendors who supply VW with parts and services, and is a major contributor to the most significant export industry in the most stable country in the European Union. This event has the potential to be a more significant impact on Germany than the Greek Debt crisis. As the world continues to digest this scandal and the ultimate economic impact it will have there will be little economic security for the Eurozone which has been slow to recover from the financial crisis.[vi]

LOOKING FORWARD

Both the resignation of Boehner and the Volkswagen scandal provide perfect examples of how a Surprise event can have a ripple effect through an economy at a time when the Security and safety of investors are being tested. Caterpillar announced layoffs of more than 10,000 workers just a few days ago, Microsoft laid off 7,600 employees in July, Hewlett Packard trimmed their workforce (again) by 25,000 workers, we have to wonder what the workers of VW are thinking.[vii]

The data suggest the global economy is currently expanding as a whole, just at a slower pace. Whether this slowdown trickles into a recession will remain to be seen.

The Federal Reserve has consumed much of our attention and Chairwoman Janet Yellen, holds the markets in her sway as we wait for her to announce a rate increase. To continue the theme of surprise, if the Fed acts in a way which the market is not expecting, volatility is likely to increase. We are reminded of the significant power the tool of Surprise can wield for the Federal Reserve. If the Fed feels they need to shock the system and make an adjustment to monetary policy, that change may not be represented by current market expectations. We believe this is a significant potential source of volatility either up or down in the future.

We remain committed to the protection of your assets and the growth of your investment portfolio. Our focus is to protect value, provide you with trusted advice, and assist you and your family in making good decisions over your lifetime. At this point we remain cautiously optimistic of the direction of the markets and are fully allocated across our model portfolios.

We thank you for your continued trust and support. Your input is always welcome and we ask that you contact us with any questions or concerns.

DISCLOSURE

All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy. All economic and performance data is historical and not indicative of future results. Market indices discussed are unmanaged. Investors cannot invest in unmanaged indices. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards.

Investing in securities in emerging markets involves special risks due to specific factors such as increased volatility, currency fluctuations and differences in auditing and other financial standards. Securities in emerging markets are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments.

An index is a statistical measure of change in an economy or a securities market. In the case of financial markets, an index is an imaginary portfolio of securities representing a particular market or a portion of it. Each index has its own calculation methodology and is usually expressed in terms of a change from a base value. Thus, the percentage change is more important than the actual numeric value. An investment cannot be made directly into an index.

Investing in fixed income securities involves credit and interest rate risk. When interest rates rise, bond prices generally fall. Investing in commodities may involve greater volatility and is not suitable for all investors. Investing in a non-diversified fund that concentrates holdings into fewer securities or industries involves greater risk than investing in a more diversified fund. The equity securities of small companies may not be traded as often as equity securities of large companies so they may be difficult or impossible to sell. Neither diversification nor asset allocation assure a profit or protect against a loss in declining markets.

Past performance is not an indicator of future results.

Securities offered through 1st Global Capital Corp., Member FINRA and SIPC. Bruce Rawdin-Baron, Steven W. Pollock, Sean Storck and Nicole Albrecht are Registered Representatives of 1st Global Capital Corp. Investment advisory services, including RBFI portfolios offered through Rawdin-Baron Financial, Inc. IMS platform accounts offered through 1st Global Advisors, Inc. Rawdin-Baron Financial, Inc. and 1st Global Capital Corp. are unaffiliated entities. Rawdin-Baron Financial, Inc. is a Registered Investment Adviser. Placing business through 1st Global Insurance Services. Registration does not imply a certain level of skill or training. We currently have individuals licensed to offer securities in the states of Arizona, California, Illinois, Indiana, Kansas, Massachusetts, Michigan, New York, Oregon and Washington. This is not an offer to sell securities in any other state or jurisdiction. CA Department of Insurance License: Bruce Rawdin-Baron #0736631, Steven W. Pollock #OE98073, Sean Storck #0F25995 and Nicole Albrecht #0F99962.

Copyright © 2015 Rawdin-Baron Financial Inc., all rights reserved.

Rawdin-Baron Financial, Inc., 4747 Morena Blvd, Ste 102, San Diego, CA 92117