Saving for college: Start here

When it comes to building a financial plan, our goal is to help you achieve your goals. Often, clients want to help their children pay for college. And while we love helping families work toward this goal, we’ve also noticed a number of misconceptions around how college fits into a broader financial plan.

In this article, we’ll walk through some of the big questions we want clients to be thinking about as they start to think about how to build saving for college into a financial plan.

Are you sure your kids will go to college?

The cost of college is growing quickly. For decades, it exceeded the rate of inflation … significantly. (Nationwide, the College Board estimates the cost of a four-year, in-state public university increases around 5% each year, compared to the average rate of inflation, which is about 3%, historically.)

Gen Z (the generation just starting to hit adulthood in the 2020s) is taking note. Surveys show this group questioning whether a traditional college education is worth it while a growing number elect to attend a trade school.

Of course, attending a trade school still costs money, and many of the tools to help parents save for a post-high school education can be used at institutions beyond a traditional college. But it’s important for parents thinking about how paying for college fits into their financial plan to realize that “college” may mean something different when their kids graduate high school.

How does paying for college impact your retirement?

It may be one of the most cliched sayings in personal finance, but it’s cliched for a reason: There are loans to pay for college; there are no loans to pay for retirement. Beyond that, college costs a significant amount of money. And it often has a significant impact on the timeline and savings goals reflected in a financial plan.

We’ve seen clients on track to retire at 62 who would need to delay retirement by more than a few years when college planning is added to the mix. That’s because the amount of money added to the “college fund” means less is going toward retirement, which impacts timelines — sometimes dramatically.

That’s not to discourage folks, we simply want our clients to be aware of how this major expense affects the full trajectory of their financial future, from how an increased savings target might affect daily budgeting to the timeframe it takes to reach big goals.

Are you saving efficiently?

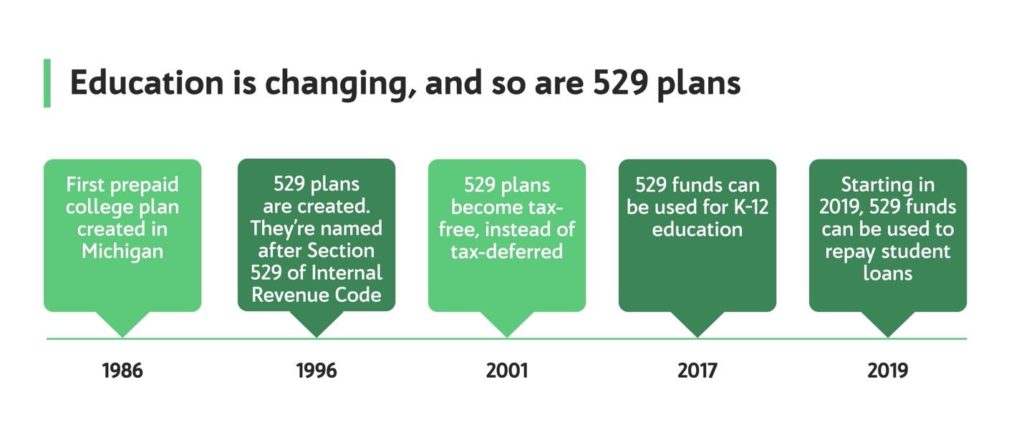

529 plans are a preferred tool to help parents (and grandparents) save for college. You contribute after-tax money to a 529, but any potential returns aren’t subject to federal taxes. Unlike IRAs, there’s no maximum contribution amount, though individual plans may impose limitations. (Generally, plans don’t want people contributing more than the expected cost of education.)

It’s also possible for other people, not just the account owner or custodian, to contribute to a 529 plan. That means friends or relatives who want to contribute directly to a child’s education can do so. Some states offer tax credits or deductions for contributing to plans, though California does not.

With any 529 plan, the expenses must be used for qualified educational expenses to avoid a tax penalty. The definition for qualified educational expenses has been expanding slowly — in the past, it was limited to use for traditional colleges. Now, it applies to trade and vocational schools, and can even be used for pre-collegiate education. It can also be used for books and other qualified school supplies.

However, it may be possible to use funds in a 529 account in case of emergency. If you dip into the funds in a 529 for noneducation-related expenses, any potential returns on the initial investment may be subject to income tax and a 10% penalty.

Each state (with the exception of Wyoming) has its own 529 plan, though you’re not limited to using your state’s option. Often, states have two plan options — one that’s available for the public to invest in directly, and one that can only be accessed by financial professionals.

Each plan has a different mix of investments and different fee structures. Plus, there are different types of 529 accounts: traditional and custodial (more on that in the next section). If it sounds complex, it can be. It’s not uncommon for even do-it-yourself investors to tap financial professionals for help selecting a 529.

Have you considered all of the factors?

The first thing to know with 529s is: There are two major players, the account owner, and the account beneficiary.

In a traditional 529 plan, the account owner maintains control of the account. They can change the beneficiary at any time and withdraw funds. So, for instance, you could open the 529 and name your child the beneficiary. At a later date, you could update the beneficiary to be another child, or even yourself.

In a custodial 529 plan, the beneficiary gains control of the account when they reach legal age. In this type of plan, the parent acts as a custodian, and not an owner, so parents can’t withdraw funds once they’re added. With this type of 529, you wouldn’t be able to dip into the account in an emergency.

One major consideration when deciding which type of plan to use is how the plan could potentially affect your child’s financial aid package. When you fill out the Free Application for Federal Student Aid (FAFSA), any 529 plans owned by the student or parent are reported as assets. That means if parents created

traditional 529 plans for more than one child, all of the plans are counted as assets, not just the plan intended for the child applying for aid.

So, if a couple with two children created traditional 529 plans for both children, both plans would count as assets when the eldest child applies for aid, which may mean less need-based aid. If the parents had created custodial accounts for each child, only the account benefiting the eldest child would be counted as an asset, and she might qualify for more aid. On the other hand, if the couple had used custodial accounts and the eldest child decided not to pursue further education, the custodians (parents) wouldn’t be able to update the beneficiary or redirect the funds.

Have you considered other options?

There are a number of ways to save for a child’s college aside from 529s, including UGMA and UTMA accounts. These accounts are part of the Uniform Gift to Minors Act (UGMA) and the Uniform Transfer to Minors Act (UTMA). These accounts allow you to gift assets to minors without worrying about the gift tax up to a certain amount.

These accounts do not need to be used for any specific purpose, such as education. However, they are structured as custodial accounts (meaning the donor must act as a fiduciary to the minor, or invest the assets in the minor’s best interest). Unlike 529s, which aren’t reported on annual tax forms, these accounts must be reported, and are linked to the beneficiaries Social Security number.

You might also consider student loans — which can be done by either you or your child.

I caution parents to think carefully about incurring debt to pay for education. While it’s generally considered a good idea to invest in education, not every degree comes with the same earning potential, and not every college comes with the same networking opportunities and job prospects.

Before you take on debt to pay for your child’s college, make sure to discuss their career goals and your expectations. Repaying this type of debt, much like setting aside additional funds to save for college, can often delay retirement significantly. And it could force you to rethink other goals as well.

It’s important to make these decisions with all of these factors in mind. There’s an understandable temptation to prioritize our kids and their goals above more practical considerations, but the financial implications can be far reaching. That’s one of the biggest things we discuss with clients so they can create holistic goals that make sense both financially and emotionally.

If you have any questions about how to build college planning into your overall financial plans, set up an appointment to discuss.

Content in this material is for general information only and is not intended to provide specific advice or recommendations for any individual.

Sources: IRS, Department of Education, and SavingforCollege.com, which keeps an up-to-date list of 529 account fees and performance by state.