Three considerations to make before turning on Social Security

Three Consideration to make before turning on Social Security

Planning Intelligence by Steve Pollock

![]()

Retirement planning is financial planning intelligence at its highest level. It requires the balance of understanding your unique vision of retirement, making rational assumptions about the future, and applying analytics to make informed decisions.

During this process one of the most frequent questions we face, usually just after “Can I retire?”, revolves around claiming Social Security benefits at the most opportune time.

Here are the three primary factors we take into consideration when determining the best strategy for a client to maximize their social security benefit.

1. Identify your Social Security Break-Even Age.

We recognize that our time is limited and need to consider how long we reasonably anticipate being alive. The less morbid way to approach life expectancy is as a statistical number. According to data compiled by the Social Security Administration, a 65-year-old male can expect to live on average until age 84.3. An average woman turning age 65 can expect to live to age 86.6. However, averages only take us so far and the data points out that 25% of those age 65 today will live past the age of 90. 1

In reality, life expectancy is unique to every individual and their set of circumstances. A simple search of Web M.D. provides numerous publications for what enhances and detracts from one’s life expectancy. We therefore need to take into consideration your unique circumstances, mainly focused on your overall health and family history. This allows you to make an educated assumption to how long you think you may live.

Armed with your life expectancy assumption we can identify the break-even point to compare claiming your benefit at age 62, full retirement age, or age 70.

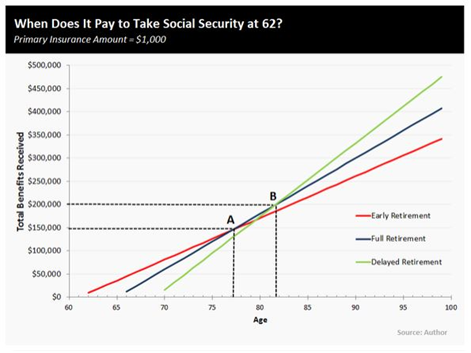

A basic break-even analysis can help illustrate your optimal filing age based on your life expectancy. From figure 1 below, point “A” shows that if you were to live past age 77, then waiting to claim your benefit until age 66 would begin to be more advantageous. If you project your life expectancy past age 82, then you would have the greatest lifetime benefit by waiting until age 70 to claim your social security benefit.

Source: Social Security: Why Taking Benefits at 62 Is Smarter Than You Think, John Maxfield, May 2014

From a very quantitative standpoint and using the average mortality tables, our Social Security analysis always leans toward waiting until age 70 to claim your Social Security Benefit.

2. Marital status and planning for the Survivor Benefit.

Your marital status complicates the Social Security equation. We now take into consideration both partners’ life expectancy along with their available survivor’s benefit. The survivor’s benefit is an important consideration and it provides the surviving spouse with the greater of the couple’s social security benefits at the passing of their spouse.

The following married couple’s set of circumstances helps illustrates that its not always about life expectancy as shown above.

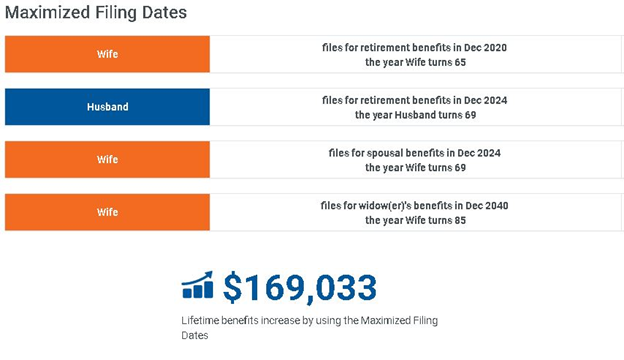

Example: Same Age, Different Life Expectancy and SS Benefit

Husband Age: 62

Husband SS Benefit: $2,500/month

Life Expectancy: 85

Wife Age: 62

Wife Social SS Benefit $1,500/month

Life Expectancy: 95

In the example above the husband and wife are the same age; the husband has a higher benefit and average life expectancy. The analysis shows the family will have received a $169,000 greater benefit over their joint lifetime if the Wife begins to claim benefits at full retirement age and switches to their survivor benefit at the passing of her spouse.

This example shows the nuances of planning for a married couple’s social security benefit. The analysis disagreed with our longevity break-even data and suggests one spouse turn on social security before age 70.

3. Time value of money and entitlement risk.

Our third consideration is the most compelling reason why many do not wait until age 70 to claim social security. There is economic benefit in not having to supplement your retirement with your own assets early in retirement. The economic benefit, coupled with an unknown state of the Social Security System, provide a well-reasoned contrary to our first consideration and the break-even analysis.

Time Value of Money

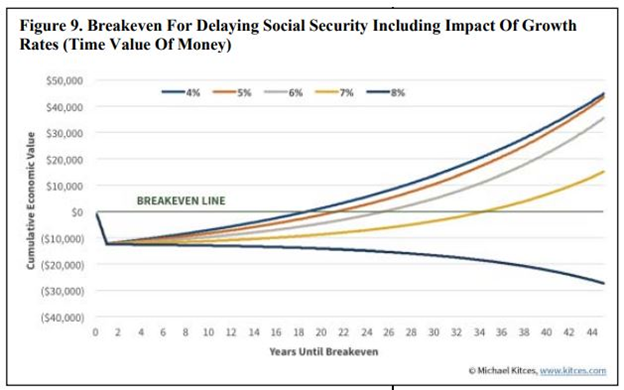

We take our break-even analysis one step further when considering the time value of money. When you collect Social Security early and therefore reduce your need of withdrawing money from your investments, the money you keep invested continues to grow. The impact of growth on the assets has the potential to stretch the break-even age further and is dependent on the growth rate you experience on your investments.

Provided in the figure below is an example of how different growth rates impact the years until you break even. For instance, if you claimed social security at age 62 and allow your invested dollars to continue to grow at a 6% rate of return each year, you would have stretched the break-even point from 13.5 years to almost 25 years.

Source: Kitces, Michael. The Kitces Report Volume 1, 2016, “The New World of Social Security Planning”

Entitlement Risk

Deferring your Social Security benefit for as long as possible creates a heightened entitlement risk. Entitlement risk is the risk that a social program which you have paid into for the duration of your career will not deliver expected or promised benefits.

It is no secret that Social Security projections show that it is grossly underfunded. Projections provided by the Treasury Department continue to indicate that the Social Security fund will be depleted by 2035. While some recent legislation has been enacted to reduce abuse to the Social Security System, it will require more attention. 2,3

Claiming your benefit early reduces the risk related to the unknown state of the Social Security System and how it could impact your future benefit.

Your Reason

The timing of when to claim Social Security is different for everyone. Reason Financial is your team of highly specialized professionals in retirement planning to help you navigate and plan the best strategy for you.

Enabling you and your family to make a lifetime of rational, informed and well-reasoned financial decisions gives us purpose in what we do. Thank you for your continued trust.

Your Truly,

Endnotes

1. Social Security Administration. “Calculators: Life Expectancy” https://www.ssa.gov/planners/lifeexpectancy.html

2. Ted Knutson. “Social Security, Medicare Trust Funds Get Extra Year Of Breathing Room.” http://www.fa-mag.com/news/social-security–medicare-trust-funds-get-extra-year-of-breathing-room-33690.html?utm_content=buffer215c5&utm_medium=social&utm_source=twitter.com&utm_campaign=buffer

3. Social Security Administration. “Retirement Planner: Recent Social Security Claiming Changes.” https://www.ssa.gov/planners/retire/claiming.html